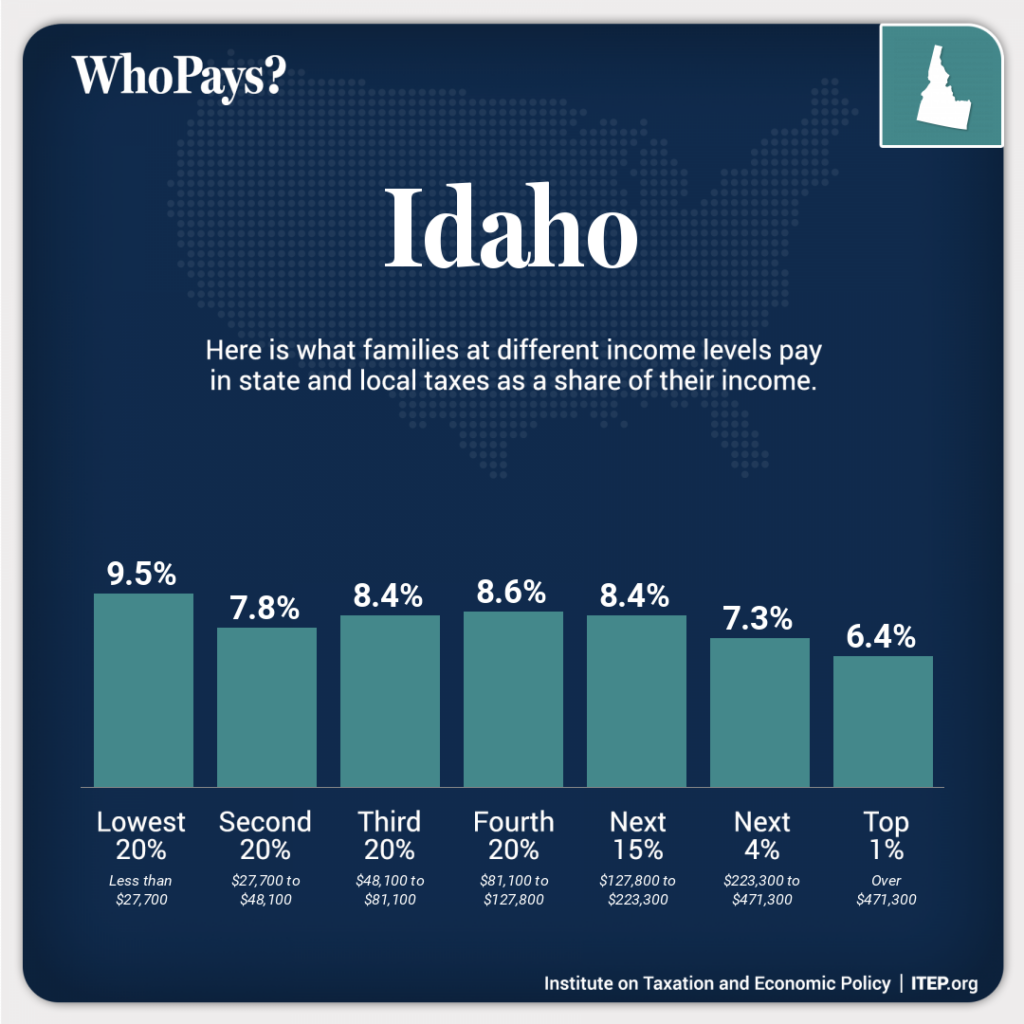

Idahoans deserve to have a fair tax system that does not disproportionately burden the taxpayers with the lowest incomes. However, the latest edition of the Institute on Taxation and Economic Policy’s Who Pays? report finds that Idaho’s tax system is regressive, meaning the wealthy pay a smaller share of their income in taxes than low-and middle-income families, and tax policy changes approved by the Idaho Legislature since 2018 have continued to shift this burden to Idahoans with lower incomes. The Who Pays? report is the only analysis that explores how tax systems impact income groups differently in all 50 states and the District of Columbia.

“The Who Pays? report highlights the inequality in Idaho’s tax system and how it can be improved to work for all Idaho families,” states May Roberts, policy analyst at Idaho Center for Fiscal Policy. “Lawmakers could help fix this imbalance in the tax code by putting money back into the pockets of Idaho’s working families. This could be achieved by enhancing the property “circuit breaker” credit to meet the needs of homeowners with modest incomes, implementing an earned income tax credit, making the child tax credit refundable, and increasing the state grocery tax credit.”

The report’s key findings for Idaho:

- Idaho has the 36th most regressive tax system in the nation.

- Working Idahoans who earn the least face a state and local tax rate that is 48 percent higher than the top 1 percent of households.

- The flattening of the state income tax over the past few years has made the tax code more regressive.

- Idaho is one of 41 states that tax the top 1 percent less than every other income group, and one of 34 states that tax their residents with the lowest incomes at a higher rate than any other group.

Idaho, like many states with tax codes that already increase economic inequality, doubled down on regressive tax policies in recent years with deep tax cuts benefiting more affluent households and wealthy corporations. Such policy decisions have implications for the revenue available to fund schools, roads, and public safety operations Idahoans rely on.

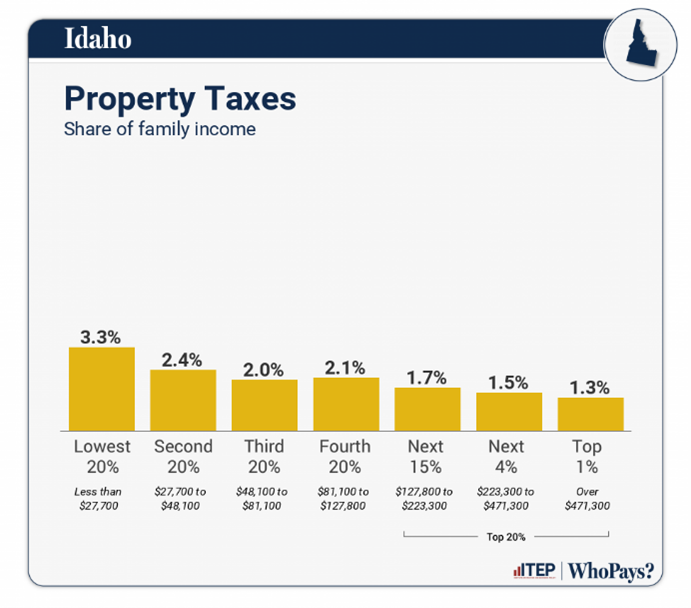

Property taxes, based on the assessed value of a home, are regressive. In Idaho, low-wage families pay almost two and a half times more, as a share of their income, than the best-off families, the report finds. Idaho could provide relief to Idahoans with modest incomes by enhancing the property “circuit breaker” and creating a renter’s credit.

“When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that,” says Carl Davis, ITEP’s Research Director. “There’s an alarming gap here between what the public wants and what state lawmakers have delivered.”