Idaho has the opportunity to support families and improve our tax system by passing a renter’s credit, expanding our state’s Child Tax Credit, and establishing a state Earned Income Tax Credit. Putting cash back in the hands of Idahoans with modest and low incomes will alleviate their budget and help them afford medications, medical visits, childcare, nutritious foods and other necessities.

Idaho’s Current Tax System

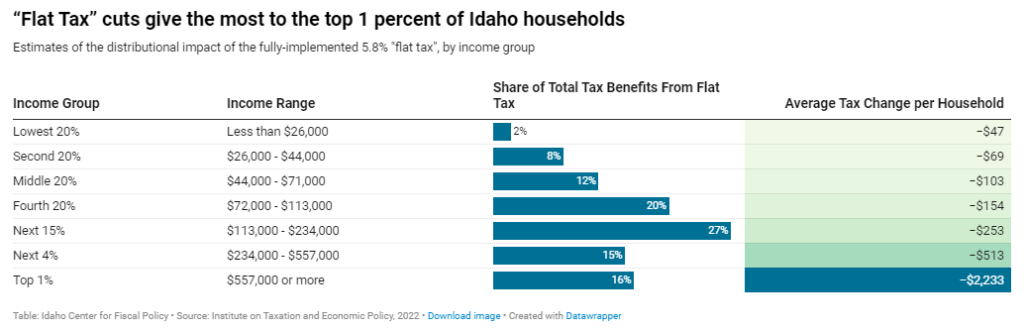

The Idaho Legislature passed a bill during a special session in 2022 that changed our tax system from a graduated rate income tax to a flat tax system of 5.8%.[1] Removing income-based tax brackets and setting Idaho’s income tax at “flat” 5.8 percent on all taxable income regardless of one’s income level or assets. Most Idaho households would not see a significant change in their tax bill from the change to a flat tax. A flat tax system is claimed to lower taxes across the board, but it lowers taxes for high-income households and corporations and results in a higher tax burden for households who are already struggling to afford rent, gas, groceries and childcare. When the legislature passed the bill to make this change, it was projected that the top 20 percent of households – those with incomes of $113,000 and above – will receive 58 percent of the overall benefits and the remaining benefits will be spread out among the 80 percent of Idaho’s households whose incomes are below $113,000. The top one percent of income earners will receive a $2,233 income tax cut and families earning around the median income will receive $103 on average from the cut.[2]

Property and Renter Credits

Circuit breaker

Idaho’s Property Tax Reduction program, known as the circuit breaker, provides a property tax credit for homeowners whose property taxes consume a disproportionately large share of their income. The circuit breaker can reduce property taxes by up to $1,500 on a home with up to one acre of land.[3] It is available to seniors, people with disabilities, and widowed people whose income is less than $37,000 in the tax year 2023. Income eligibility for this program is capped at a 185 percent of the Federal Poverty Level (FPL) for a household of two. The assessed value of an applicant’s home can be up to $400,000 or 200 percent of the median assessed value of all homes in the county that receive the homestead exemption.

Including Renters in Tax Relief

The Idaho legislature passed a complex property tax relief bill during the 2023 legislative session that excluded renters from relief even though Idaho renters pay property taxes through rent. Idahoans continue to struggle staying housed due to rental prices rapidly outpacing wage growth, especially Idahoans over the age of 65. Idaho rents have increased by 24 percent in the last 5 years (inflation-adjusted). Further, many of these individuals rely on Supplemental Security Income (SSI), which is capped at $841 for an individual and $1,261 for a couple. [4] Rent consumes nearly all of retirees’ social security income, with the average one-bedroom rental in 2022 priced at $934 a month.[5] Creating a renter credit similar to the circuit breaker would help relieve financial stress on over 17,000 renters who are 65 and older.

Idaho’s Current Child Tax Credit

Idaho established a non-refundable Child Tax Credit (CTC) in January 2018. Families may qualify to receive $205 dollars for each qualifying child who is under the age of 17 or is permanently disabled.[6] A nonrefundable credit means that people who owe very little or nothing on their income taxes are not able to claim the full value of the credit, resulting in negligible benefits for households in the lowest income range. Idaho families raising children face high costs in our growing state, such as child care that on average costs families over $8,000 annually in Idaho.[7] Making the CTC refundable would give families a boost that can help them combat the rising costs of child care and housing. In 2021, 194,440 Idaho families claimed the CTC, yet roughly 9,000 households do not receive the Child Tax Credit due to the qualifying age. Expanding eligibility to children under the age of 18 would close the gap and ensure the parents of an additional 39,000 children in those households are able to claim the child tax credit. On average, young adults do not leave home until age 19 with nearly half retiring back home before they turn 27. Due to age limitation on the Child Tax Credit, nearly 9,000 families are unable to receive the benefit will caring for their child in their most consequential time.[8] Closing the gap by expanding the CTC to include children under age 18 would ensure the households of nearly 40,000 children are accessing this benefit. Putting money back in the hands of parents to support their children.

Grocery Tax Credit

Idaho established a grocery tax credit to help offset the sales tax Idahoans pay on groceries throughout the year. Idaho residents receive an average of $100 dollars per person and may be able to claim grocery credit for their dependents.[9] Idaho residents that are not required to file an income tax return or didn’t make enough money to file are still eligible to receive a grocery tax credit refund.

Earned Income Tax Credit

A refundable Earned Income Tax Credit (EITC) is a tax credit that can put dollars back in the pockets of working families or lower their taxes during tax season. Families typically claim an EITC for only 1 or 2 years.[10] If Idaho established an Idaho Working Families Tax Credit that is 10 percent of the federal credit, it would cost $30 million, at 15 percent of the federal credit, it would cost $45 million.[11] Over 131,000 working families would qualify for a state EITC .[12]

- An Idaho Earned Income Tax Credit would let low- and moderate-income working families keep more of their earnings to help pay for things such as childcare and transportation.

- An EITC would bring more Idahoans back to the workforce. Evidence shows that this credit can increase labor force participation helping address some workforce shortages.

- By giving a tax cut to Idahoans of modest means, the EITC would increase consumer spending, which would then boost local economies across the state.

Providing tax credits for working families strengthens local economies:

Idaho lawmakers should prioritize putting cash in the hands of working families by providing targeted tax relief to those that need it the most. Providing tax relief for working Idahoans benefits our state and community by increasing consumer spending, thus boosting local economies across the state. The following actions would help working families and strengthen Idaho’s economy:

1. Create a renter tax credit for families with low incomes to combat the rising cost of housing in the state.

2. Expand the Child Tax Credit to include 17-year-olds as qualifying children so parents can receive relief on the expenses, they pay to cover all of their children.

3. Expand the Child Tax Credit by making it refundable so that families can afford (have cash to pay for) necessities like school supplies and childcare.

4. Create a state Earned Income Tax Credit to put cash back in the pockets of hardworking families to spur local economic growth.

[1] Cerna Rios, Alejandra, “2022 Special Legislative Session: Understanding Impacts of the Tax and Education Bill”, Idaho Center for Fiscal Policy, August 30, 2022, Accessed at: 2022 Special Legislative Session: Understanding Impacts of the Tax and Education Bill - Idaho Center for Fiscal Policy (idahofiscal.org)

[2]Ibid.

[3] Idaho State Legislature. House Bill No. 292. Accessed at: https://legislature.idaho.gov/wp-content/uploads/sessioninfo/2023/legislation/H0292.pdf

[4]“What’s New in 2022?”. Social Security Administration. Accessed at: https://www.ssa.gov/redbook/newfor2022.htm#:~:text=Federal%20Benefit%20Rate%20(FBR),month%20for%20an%20eligible%20couple

[5] “Access the latest rental market data for your city, state, county, or metro.” Apartment List. Accessed at: https://www.apartmentlist.com/research/category/data-rent-estimates

[6] Idaho State Statute. Title 63. Chapter 30. Section 63-3029L. Accessed at: https://legislature.idaho.gov/statutesrules/idstat/title63/t63ch30/sect63-3029l/

[7] Allen, Emily. “Child Care is Essential for Working Families.” Idaho First Steps Alliance. Accessed at: https://www.idahofirststeps.org/wp-content/uploads/2022/12/FirstSteps_FPL-Brief_FINAL.pdf

[8] “Independence for Young Millenials: Moving Out and Boomeranging Back.” Monthly Labor Review, Bureau of Labor Statistics. December 2014. Accessed at: https://www.bls.gov/opub/mlr/2014/article/independence-for-young-millennials-moving-out-and-boomeranging-back.htm

[9] Idaho State Statute. Title 63. Chapter 30. Section 63-3024A. Accessed at: https://legislature.idaho.gov/statutesrules/idstat/Title63/T63CH30/SECT63-3024A/

[10] Dowd, T., & Horowitz, J. B. (2011). Income Mobility and the Earned Income Tax Credit: Short-Term Safety Net or Long-Term Income Support. Public Finance Review, 39(5), 619–652. https://doi.org/10.1177/1091142111401008

[11] “Program Participation Data Dashboard.” Center on Budget and Policy Priorities. Accessed at: https://apps.cbpp.org/program_participation/#table/367/eitc--ctc--and-actc-claims

[12] Ibid.