Every year, Idaho tax dollars are spent to ensure families receive a good education, live in safe communities, experience good health, and drive on safe roads. However, over the past four years, lawmakers have passed deep and costly tax cuts and reforms. These cuts were made in response to temporary budget surpluses that were largely driven by federal pandemic relief, but they have long term consequences. The changes to Idaho’s tax code —which are permanent and tilted toward wealthy households and corporations — weaken state revenues by growing amounts over time, limiting the state’s ability to maintain support for schools and other vital public services. The changes also made the state’s tax system more regressive, disproportionately burdening Idaho households with the lowest incomes.

How do income tax cuts impact Idaho’s economic stability?

Idaho lawmakers cut the income tax rate four times over the last four years, greatly reducing the amount of revenue going into the state’s General Fund. The General Fund is the main source of money for core public services like transportation, education, and public safety. From FY 2022 to FY 2024, Idaho lost nearly $1.9 billion dollars in revenue due to income tax cuts. The state is projected to lose an additional $948 million dollars in FY 2025 onward annually, resulting in a cumulative total of $2.8 billion dollars in annual revenue loss as of FY 2025.[1] And these deep tax cuts will keep chipping away at Idaho’s revenue stream. When the next recession hits the economy, a lack of revenue may force cuts to education and other important public services and resources. A recession could also prompt an increase in other taxes, such as sales and property taxes, which hit lower-income families and communities harder than wealthier ones.

Without tax cuts, Idaho could better support public programs that help low- and middle-income families.

Idaho will experience an estimated annual loss of $948 million in revenue due to the four rounds of deep tax cuts. These tax cuts benefit the wealthy more than the average Idahoan, and this lost revenue could have been used to invest in programs and policies that make meaningful differences in the lives of everyday working families:

- Promoting the development of 1,100 affordable housing units for families with incomes below 80% of the Annual Median Income (AMI) would cost $50 million.[2]

- Providing full day kindergarten for all Idaho families would cost $47 million.[3]

- Creating a state Earned Income Tax Credit at 15 percent of the federal credit would cost $45 million.[4]

- Making the state Child Tax Credit refundable would cost $29 million, helping over 80 thousand families.[5]

- Raising the Children’s Health Insurance Program (CHIP) coverage income limit for children up to 255 percent of the Federal Poverty Level (FPL) would cost nearly $27 million, benefiting nearly 32,000 children.[6]

- Raising the Medicaid coverage income limit for pregnant women to 205 percent of the Federal Poverty Level (FPL) would cost the state $846,000, benefiting over 900 women.[7]

How do income tax cuts impact Idaho families?

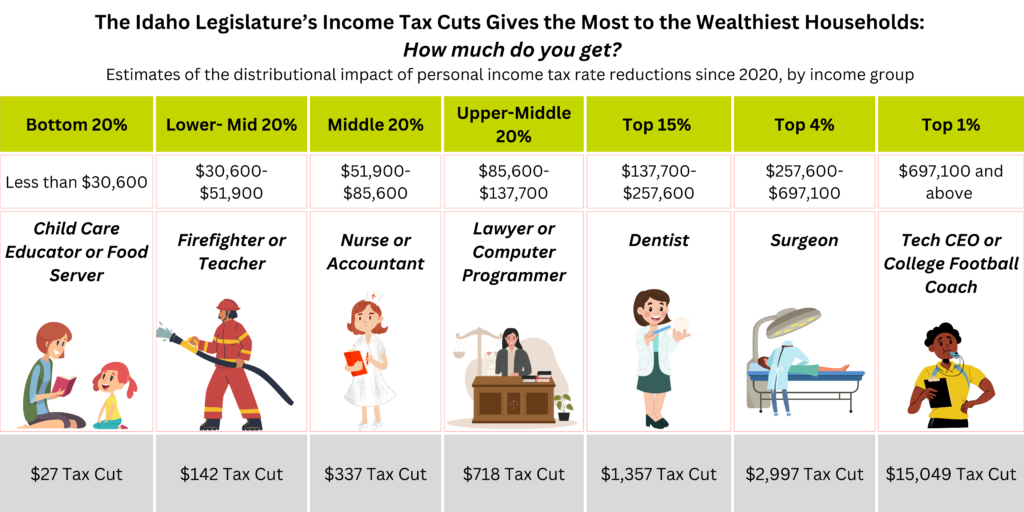

Everyone should benefit from the state’s tax system, and tax relief should be aimed towards those that need it the most. But Idaho’s recent string of broad-based income tax cuts does little to help families with low- to middle- incomes. The bulk of permanent income tax cut benefits flow instead to the wealthiest households and corporations, not individuals and families struggling to afford gas, groceries, and childcare.

Before 2021, Idaho had a progressive income tax rate that gradually increased as taxable income increased. With the tax cuts over the past four years, however, the state has steadily flattened the income tax by reducing the number of income brackets from seven to one and lowering the top individual and corporate income tax rate from 6.9 to 5.695 percent. Idaho now has a “flat” income tax rate that charges the same tax rate to everyone.

This flattening of Idaho’s income tax ultimately creates a regressive tax structure for Idaho individuals and families, because there is no longer a progressive income tax structure to balance the regressive nature of sales and property taxes. Regressive taxes charge everyone the same rate, regardless of their ability to pay, resulting in those with lower incomes paying more of their share of income on taxation than those with higher incomes. See the “Tax Systems Explained” section for more.

Tax Systems Explained

Tax systems are usually composed of progressive, regressive, and proportional taxes. Progressive tax systems take a larger percentage of income from high-income groups than low-income groups (ex. federal income tax). Regressive tax systems take a larger percentage of income from low-income groups than high-income groups (ex. sales and property tax). Usually, the combination of these taxes taken together, along with certain tax credits, results in taxpayers paying roughly the same percentage of their incomes in taxes, creating a proportional tax system. Idaho’s current tax system does not reflect that. When all the state’s taxes and tax credits are taken together, Idaho’s overall tax system is regressive.[8]

In the 2024 Legislative Session, the Idaho Legislature cut the income tax for the fourth time. The four rounds of income tax cuts reduced Idaho’s annual individual income tax collections by $725 million and annual corporate income tax collections by $223 million since 2020. While this change significantly reduced Idaho’s annual revenue by an estimated $948 million, most Idaho households do not see a meaningful change in their tax bill. The top 20 percent of households- those with income of $137,700 and above – will receive 66 percent of the overall benefits. The remaining benefits will be spread out among the 80 percent of Idaho’s households whose incomes are below $137,700. The top one percent of income earners have received a $15,049 income tax cut on average. Families earning the median income receive only a $337 income tax cut on average. [9]

[1] Institute on Taxation and Economic Policy analysis.

[2] Email from Brady Ellis on May 8, 2024.

[3] Idaho Senate Bill 1316. (2022). https://legislature.idaho.gov/sessioninfo/billbookmark/?yr=2022&bn=S1316&su=SOP

[4] Angelica Moran. “Idaho Tax Credits for Working Families.” Idaho Center for Fiscal Policy. August 9, 2023. https://idahofiscal.org/idaho-tax-credits-for-working-families/

[5] Institute on Taxation and Economic Policy analysis.

[6] IDHW estimates received February 2024.

[7] IDHW estimates received February 2024.

[8] Carl Davis et. al. “Who Pays? 7th Edition.” Institute on Taxation and Economic Policy. January 9, 2024. https://itep.org/whopays/idaho-who-pays-7th-edition/

[9] Institute on Taxation and Economic Policy analysis.