Idaho’s families, communities, and economy are best equipped to combat the coronavirus pandemic when everyone can remain safely housed. However, rapidly increasing home prices, pandemic-related income loss, and a shortage of affordable homes are still putting some Idaho families at risk for eviction, especially those that must spend more than a third of their income on rent. Because of a legacy of housing discrimination, these factors also unfairly weigh more heavily on Idahoans of color.

To address these issues, the American Rescue Plan Act (ARPA) provided states with a set of options to prevent evictions and foreclosures as well as enhance affordable housing. Lawmakers should prioritize the following uses of that assistance by:

- Approving the latest round of ARPA emergency rental assistance available to Idaho

- Creating more affordable housing by using a portion of ARPA State Fiscal Recovery Funds to fund the Idaho Housing Trust Fund

- Approving ARPA assistance for homeowners facing rising property taxes

ARPA Emergency Rental Assistance Can Prevent Eviction for More Idahoans

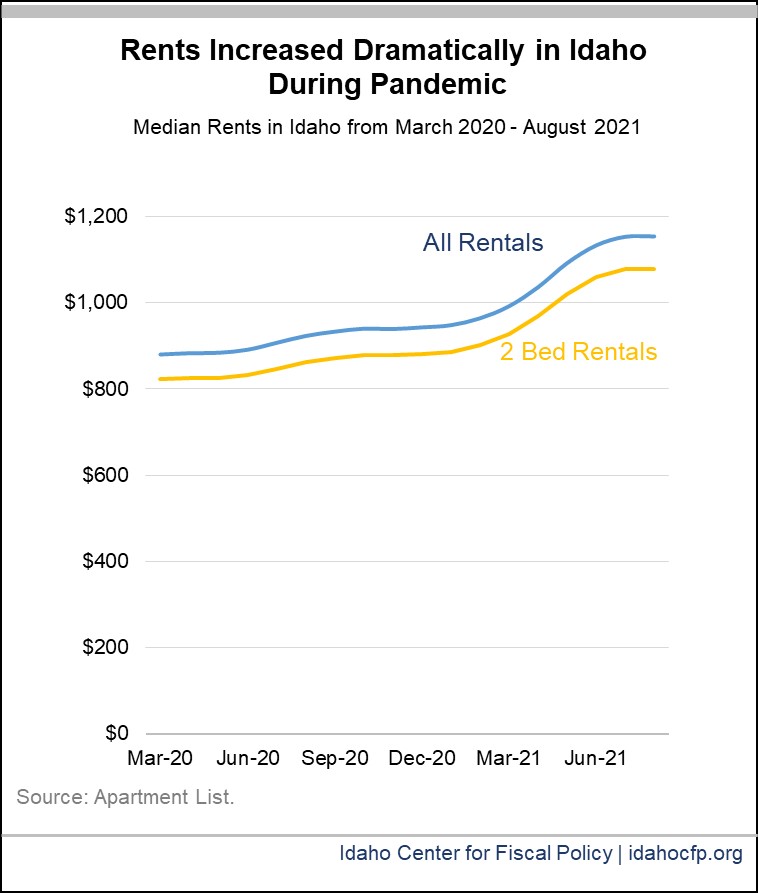

While Idaho rents have outpaced wage growth for years, the chart below illustrates how prices have grown dramatically in the last 15 months. In March 2020, median rents hovered at just below $900 per month for all rentals. By August 2021, median rents were almost $1,200 per month for all rentals. This means rents grew by an astounding 31 percent during this time period.

Because rents climbed significantly during a period of job and income loss, many families now face a backlog in rent. In December 2020, Idaho renters owed between $73 million and $103 million in unpaid rent, and 34,000 Idaho households were at risk of eviction.i In the summer of 2021, at least one in ten renters across Idaho was still behind on rent. Across all Idaho counties, renters owed an average amount of back rent ranging from about $2,000 to almost $4,000 per household.ii Households behind on rent are at risk of experiencing eviction and possibly homelessness, both with far-reaching economic consequences for individuals, families, and communities. Limited access to housing supports or assistance forces many Idahoans to pay housing costs in unsustainable ways, such as spending down emergency savings, accruing credit card debt, or turning to predatory payday loans to make ends meet. This can negatively impact the long-term financial stability of a family.

Eviction and its damaging economic impacts can be avoided by approving a second round of federal emergency rental assistance. Idaho received $200 million in its first round of federal emergency rental assistance (also known as ERA1) in December 2020, which was made available to renters with modest incomes through September 2022.iii But the American Rescue Plan Act includes an additional $152 million for emergency rent and utility assistance to Idaho, (also known as ERA2), which has not yet been approved by the Legislature. By design, ERA2 is more capable of addressing the unique needs of Idaho renters because:

- ERA2 would be available to Idahoans through September 2025, which goes further than the current rental assistance funding (ERA1) which expires in September 2022.

- ERA2 allows families to access up to six months more of assistance – for a total of 18 months.

- ERA2 removes the red tape that shut out certain renter households who are shouldering the most back-rent but cannot access difficult-to-obtain records.

Approval of ERA2 would provide the opportunity for more Idahoans to remain stably housed while ensuring landlords remain financially whole. Ensuring renters can access this critical relief during a broader range of time is essential as Idahoans continue to experience unexpected pandemic-related income hardship as a result of household members being exposed to or infected with COVID-19, school and daycare closures, falling behind on rent or credit card payments, and more. The Legislature must approve the use of these funds as soon as possible in order to provide the broadest range of assistance to all Idaho households with modest incomes at risk of losing their homes.

ARPA Homeowner Assistance Fund Could Help Address Rising Property Tax Bills

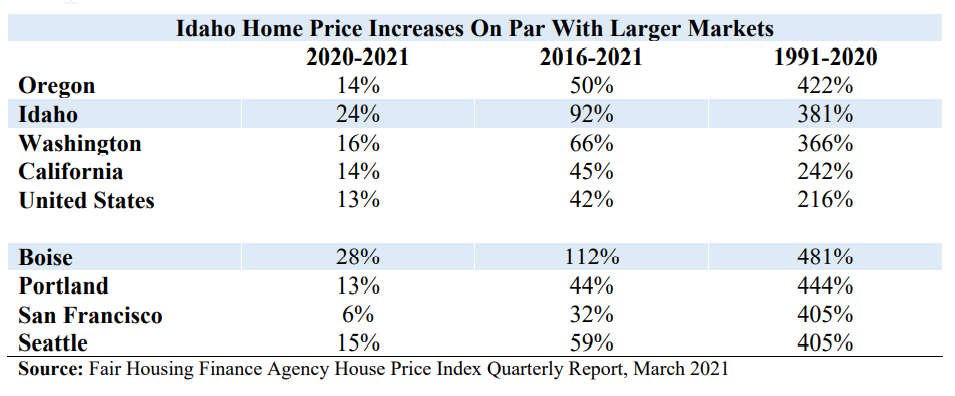

Home prices in Idaho are also on the rise – increasing rapidly before and throughout the pandemic. Over the past five years, Idaho and Boise have experienced higher increases in home prices than any other state or metro area in the nation. Rapidly rising home values increase property tax bills for homeowners with modest, limited, or fixed incomes, such as Idahoans who are elderly, living with a disability, or working a full-time job with low wages. With only limited property tax relief available through the state’s circuit-breaker program and no resources available to homeowners financially impacted by the pandemic, Idahoans struggling to afford annual property tax assessments are at risk of losing their homes.

Federal financial assistance was provided to homeowners for the first time with the creation of the Homeowner’s Assistance Fund in ARPA. Idaho’s executive branch requested $50 million in assistance to distribute through the Idaho Housing and Finance Association, but the funding was not approved by the legislature and remains unavailable to homeowners seeking financial assistance. If approved, the Homeowner Assistance Fund could provide mortgage, utility, and other financial assistance to homeowners at risk of foreclosure or displacement in the face of higher

property taxes. iv

ARPA Flexible Funds Could Be Invested in Development of Affordable Homes in Idaho

Idaho does not have enough affordable homes to meet the needs of residents. Only two of the state’s 44 counties currently have enough affordable homes. Across Idaho, there is a shortage of at least 22,000 affordable homes for families with modest incomes. As a result, four in five renters with modest incomes are paying more than they can reasonably afford on rent.v

This only heightens barriers already present for Idahoans of color. Housing policies in Idaho and elsewhere have historically increased racial segregation. Even today, housing policies mean people of color have fewer options in housing. Investing in the development of affordable homes would help lower these barriers.

State lawmakers can create more affordable homes by investing in the Idaho Housing Trust Fund. The fund was created in 1992 by the Idaho Legislature to pay for the creation, maintenance, and rehabilitation of affordable homes. At least 75 percent of the funds must be used to assist households who earn less than half of the median income in the region they live.vi Idaho lawmakers can use a portion of the state’s $1.1 billion in flexible ARPA State Fiscal Recovery Funds for this investment. The U.S. Department of the Treasury strongly suggests using funds this way, especially in communities harmed by COVID-19.

State housing trust funds have a successful track record in creating more affordable homes across the country. The Idaho Housing Trust Fund remains unused and is one of only three state trust funds that has yet to receive funding.vii As a result, Idahoans currently rely on federal and private funding for the creation, maintenance, and rehabilitation of affordable homes. But, as demonstrated by the housing shortage, the private market has not created the needed affordable homes in the absence of robust public partnership.

Conclusion

Affordable housing is essential to Idahoans’ health and economic stability. When families’ housing needs are met, they are able to spend more of their incomes on food, healthcare, and other essentials. Idaho lawmakers must approve the housing programs provided in ARPA to ensure Idahoans can remain safely housed and able to participate in the state’s recovering economy.

i Idaho Center for Fiscal Policy, “Understanding Federal Emergency Rental Assistance Funds.” January 28, 2021. Accessed at: http://idahocfp.org/new/wp-content/uploads/2021/01/Understanding-Federal-Emergency-Rental-Assistance-Funds-FINAL.pdf

ii New York Times. “How Many People Are at Risk of Losing Their Homes in Your Neighborhood?” July 28, 2021. Accessed at: https://www.nytimes.com/2021/07/28/opinion/covid-eviction-moratorium.html

iii About $176 million of ERA1 is administered by the Idaho Housing and Finance Association’s Housing Preservation Program to provide assistance to Idaho renters living outside Ada County. About $24 million is administered to Ada County residents by the Boise City/Ada County Housing Authorities’ Emergency Rental Assistance Program.

iv United States Department of the Treasury. “Homeowner Assistance Fund Guidance.” August 2, 2021. Accessed at: https://home.treasury.gov/system/files/136/HAF-Guidance.pdf

v National Low Income Housing Coalition. “2021 Gap Report.” March 2021. Accessed at: https://nlihc.org/gap

vi Idaho State Statute. Title 67, Chapter 81. Accessed at: https://legislature.idaho.gov/statutesrules/idstat/title67/t67ch81/

vii Community Change. “State Housing Trust Funds.” Accessed on August 5, 2021, at: https://housingtrustfundproject.org/housing-trust/funds/state-housing-trust-fund/