Idaho’s Tobacco and Cigarette Taxes Generate Revenue Used to Help Communities Thrive

In order for Idaho communities to thrive, they need strong public systems such as education, programs to help at-risk youth get their lives back on track, and cancer research. Our state has long used revenue from taxes on cigarettes and other tobacco products to pay for these and the myriad of other public systems that serve as foundations for resilient, thriving communities.

The taxes together bring in approximately $48 million a year, and comprise the fifth largest source of tax revenue for the state (around 1% of total revenue). The taxes also help deter tobacco use by discouraging consumption, particularly for growth.1

Introduction

As consumers switch from traditional tobacco products to e-cigarettes and related products, we may see reduced revenues from these taxes in the coming years. The U.S. Food and Drug Administration in May 2016 restricted the use of e-cigarette products to adults, suggesting there are public health concerns for these relatively new products. As more research becomes available, policymakers should consider whether to levy a similar tax on e-cigarettes.

Understanding how the cigarette and tobacco taxes currently work and how they support key programs can help to inform the public discussion to ensure that Idaho’s leaders craft prudent and common sense tax policies that will allow our communities to thrive and promote broad prosperity.

What is Taxed?

The cigarette tax applies to tobacco products wrapped in paper, taxed at $0.0285 each. For the typical pack of 20 cigarettes, the tax comes to $0.57. The tax on cigarettes generated $36.4 million in state revenues in fiscal year 2015.

Tobacco without a wrapper (e.g. chewing tobacco) or with a tobacco-based wrapper (e.g. cigars) and similar products are subject to the tobacco tax. These products are taxed at 40% of the sales price. In fiscal year 2015, Idaho collected an estimated $12.0 million from the tobacco tax.

Idaho has some of the lowest taxes on cigarettes, ranking at 41st in the nation overall. Missouri has the lowest taxes at $0.17 per pack. The highest taxing states include neighboring Washington (6th) at $3.03 per pack and New York (1st) at $4.35 per pack.

Where Does the Money Go?

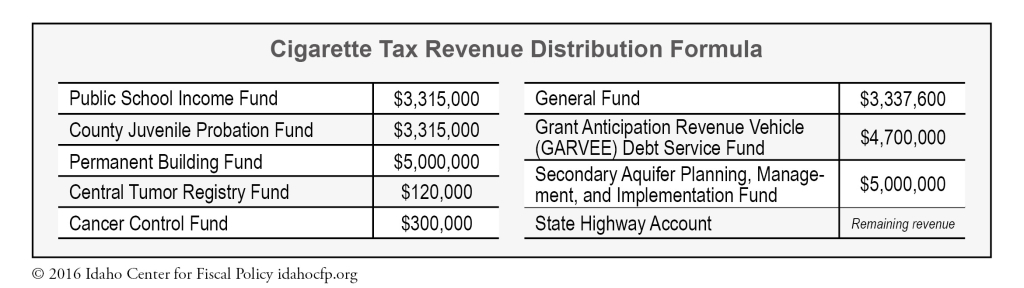

The revenue from the cigarette tax is distributed into nine state funds. These funds, like dozens of other funds that make up the Idaho budget, are drawn from to run a variety of programs and provide services to Idahoans. Currently, Idaho law outlines a distribution formula through fiscal year 2019, and provides another formula to take effect after that. The current formula distributes cigarette tax revenue as follows:2

After fiscal year 2019, most of the current funds will continue to receive distributions from the cigarette tax revenue, but some will be allocated as a percentage of the cigarette tax revenue and some as a fixed amount.7 At that time three of the funds will come off the target fund list: the GARVEE Debt Service Fund; the Secondary Aquifer Planning, Management, and Implementation Fund; and the State Highway Account. One target fund will be added: the Economic Recovery Reserve Fund will receive the remaining revenue. Further legislation can again redirect revenue to new funds under a new distribution formula.

Revenue from the tobacco tax is allocated to some of the same funds as the cigarette tax, but under a different formula. The formula mandates that 87.5% of the tobacco tax revenue goes to the General Fund. The Public School Income Fund receives 6.25% after $200,000 has first been allocated to the Idaho State Police and $80,000 to the Commission on Hispanic Affairs. The final 6.25% goes to the County Juvenile Probation Fund.

How is the tax rate set and how has it changed?

Idaho began taxing cigarettes in 1945, consistent with creation of the tax in other states. The tax on other tobacco products began in 1972. For the most part, distribution of tobacco and cigarette tax revenue has been consistent over time. The cigarette tax began with six original target funds. Two funds were added in 1995,8 one in 2005,9 one in 2007,10 and three in 2015.11 The initial tax rates were $0.001 per cigarette and 35% for other tobacco products. Since that time, the cigarette tax rate has been raised nine times, most recently in 2003 when the tax per cigarette went to $0.0285 from $0.014– the single largest increase in the history of the tax, which was enacted to fill a 2003 budget gap.12 The initial tobacco tax rate had been unchanged until it was raised in 1994 to 40% of sales price, from 35%.

The most significant change in allocation happened in 2006, when the legislature allocated revenue collected from the cigarette tax to pay for the Statehouse restoration. For fiscal year 2019 a new formula will take effect for distributing cigarette tax revenues. That change is due to the elimination of the Permanent Building Fund that was established to pay for the costs of the restoration, which have been completed.

Policy Considerations

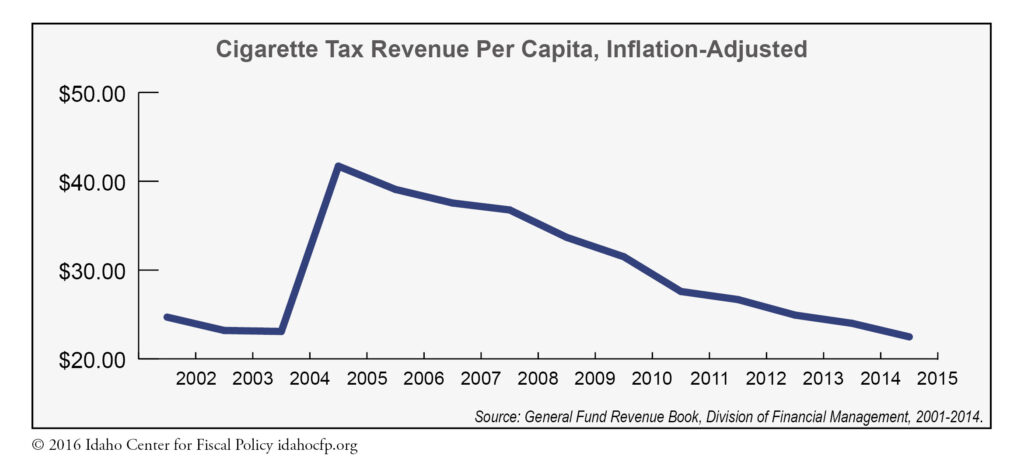

Revenue from the cigarette tax is declining when adjusted for inflation and population size, as shown by an analysis of per-capita revenue from 2001 to 2014, after a spike coinciding with tax rate increase passed in 2003:

Cigarette tax revenue could be declining for two reasons. One is that people have either reduced or quit smoking altogether.13 More significantly, an increasing number of people are switching to e-cigarettes, which are subject to the sales tax, but not the cigarette tax.14 Over the next five years, e-cigarettes are projected to start replacing cigarette and tobacco product usage. According to 2013 data collected by the Idaho Department of Health and Welfare (IDHW), about 11% of tobacco users to date have switched to e-cigarettes, or use them in tandem with traditional tobacco products.15 IDHW predicts that the use of e-cigarettes will rise exponentially.16 Therefore, the stability of this revenue stream in the long term is in question.

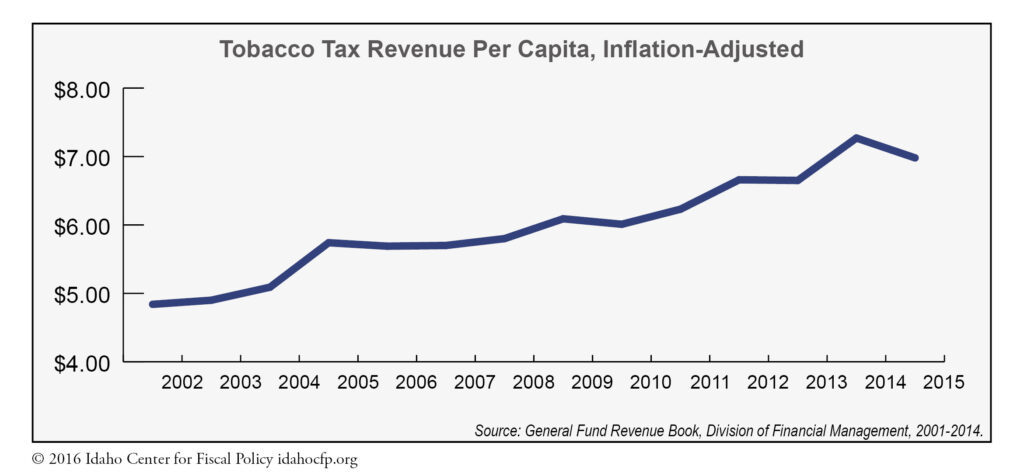

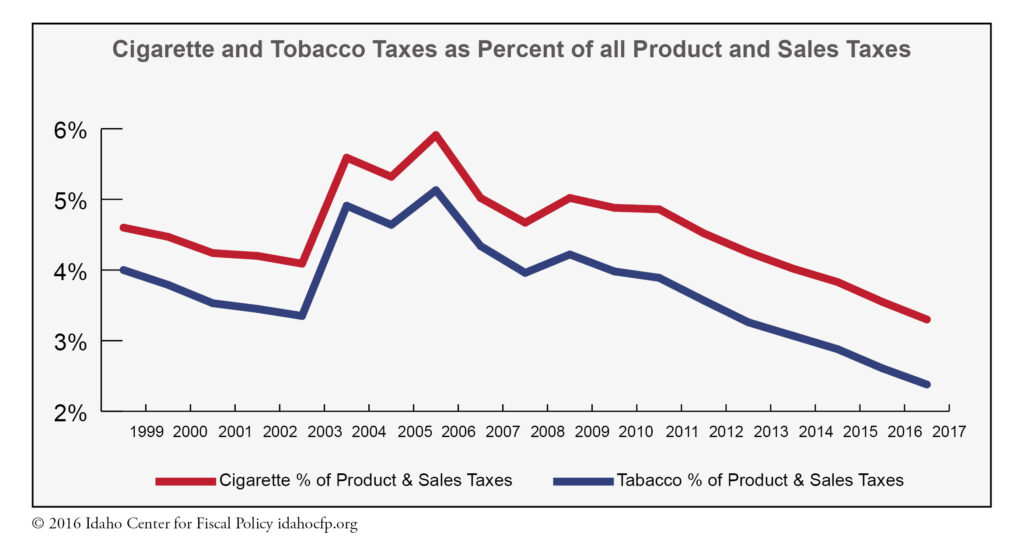

Meanwhile, per-capita revenue from tobacco products is generally increasing. This increase coincides with the 2003 hike in the cigarette tax, which may have prompted some users to switch to tobacco products, which have not been increased since 1994: When all state taxes on products are taken into account, the share of revenue from cigarettes and other tobacco products has declined consistently since 2006. Consumers could be influenced by national trends towards healthy living and tobacco cessation. As stated above, they may also be shifting from cigarettes to non-cigarette tobacco products:

When all state taxes on products are taken into account, the share of revenue from cigarettes and other tobacco products has declined consistently since 2006. Consumers could be influenced by national trends towards healthy living and tobacco cessation. As stated above, they may also be shifting from cigarettes to non-cigarette tobacco products: Still, there are signs that further revenue reduction will not take place overnight. Although revenue from cigarette and tobacco taxes has declined as a share of overall revenue from all sources, it has gained in total revenue. The gains persist after adjusting for inflation, suggesting some stability in absolute terms.

Still, there are signs that further revenue reduction will not take place overnight. Although revenue from cigarette and tobacco taxes has declined as a share of overall revenue from all sources, it has gained in total revenue. The gains persist after adjusting for inflation, suggesting some stability in absolute terms.

Recommendations to Consider

As larger numbers of tobacco users make the switch to e-cigarettes, it is reasonable to expect that state revenue from cigarette and tobacco taxes will decline permanently. To address the eventual downturn in cigarette and tobacco tax revenue, policymakers could consider one or more options:

- Apply tobacco taxes to e-cigarettes and other new tobacco products. In Idaho, e-cigarettes are subject to the sales tax but not the additional tobacco product tax. Research shows that e-cigarettes contain nicotine – an addictive chemical – and are especially appealing to young people, providing a rationale for a tax that would deter consumption, provide consistency in tax policy, and support revenue. Four states and the District of Columbia have opted to tax e-cigarettes.17 Of those, D.C. and Minnesota include e-cigarettes in the definition of tobacco products and levy the same rate. Kansas, Louisiana, and North Carolina levy rates well below that of cigarettes and traditional tobacco products, acknowledging that these products can also help people consume less of potentially more harmful tobacco products.

- Re-examine the impact on current funded programs. As revenue from cigarette and tobacco taxes declines, and targeted funding amounts remain the same in nominal terms year after year, policymakers should review the impact on funded programs. They may need to consider other funding alternatives in order to maintain these investments and achieve their public goals.

While revenue from cigarette and tobacco taxes provides critical dollars in times of need and helps reduce consumption of unhealthy products, continued reliance on both taxes for core state functions may prove problematic without additional policy adjustments to ensure stability in revenue over the long-term.

Footnotes

1. Paula Lantz, et al. “Investing in youth tobacco control: a review of smoking prevention and control strategies,” 2000. Retrieved from: http://tobaccocontrol.bmj.com/content/9/1/47.full

2. The Public School Income Fund is held by the state treasury and pays out funds to the existing beneficiaries of the Public School Endowment. When funds are unused, they generate interest.

3. Funding helps counties implement the Idaho Juvenile Corrections Act. Funds are based on the percentage of 10-17 year-olds by county. Source: http://www.idjc.idaho.gov/community-based-funds

4. The Permanent Building Fund supports construction and maintenance for state buildings including Idaho college campuses.

5. The General Fund receives an amount needed to fund the Bond Levy Equalization Program every year.

6. Funds are used for technical studies, project management services, monitoring, measurement as well as personnel costs, operating expenditures, capital outlay and water projects associated with the statewide comprehensive aquifer planning and management effort.

7. After FY 2019, the cigarette tax will be distributed as follows: the Public School Income Fund and Department of Juvenile Corrections each receive $3,315,000. The remaining amount per pack after refunds is distributed as follows: the Permanent Building Fund receives 17.3%; the Central Tumor Registry Fund receives 0.4% (to a maximum of the legislative appropriation); the Cancer Control Fund receives 1%; and the General Fund receives an amount needed to fund the Bond Levy Equalization Program. All remaining revenues are directed to the Economic Recovery Reserve Fund.

8. These funds were the Public School Income Fund and the County Juvenile Probation Fund.

9. This fund was the Economic Recovery Reserve Fund. This allocation was only effective for 2005 and 2006.

10. This fund is the Permanent Building Fund.

11. These funds were the GARVEE Debt Service Fund, the Aquifer Fund, and the State Highway Account.

12. The cigarette tax rate was changed in the following years: 1947, 1955, 1959, 1961, 1963, 1972, 1987, 1994, and 2003. The tobacco tax rate was changed in 1994, increasing the total rate from 35% to 40%. Historically, there have only been six recipients of the tobacco tax. The original tax implemented in 1972 benefited only the Water Pollution Control Fund. In 1994, when the rate was increased, the Public School Income Fund became a recipient. The County Juvenile Probation Fund received funds beginning in 1995. In 1996, the Idaho State Police began receiving $250,000 from the amount allocated to the Public School Income Fund. In 2000, the amount allocated to the Water Pollution Control Fund was shifted in full to the General Fund. In 2014, two adjustments were made: the amount allocated to the Idaho State Police dropped to $200,000 and the Commission on Hispanic Affairs began receiving $80,000 from the amount allocated to the Public School Income Fund.

13. Centers for Disease Control and Prevention, 2016. “Trends in Current Cigarette Smoking Among High School Students and Adults, United States, 1965–2014.” Retrieved from: https://www.cdc.gov/tobacco/data_statistics/tables/trends/cig_smoking/

14. Suter, Casey. “ELECTRONIC CIGARETTES: DATA UPDATE.” Idaho Department of Health and Welfare. 2013. http://cdhd.idaho.gov/pdfs/cd/e-cig_data_update_Suter_12-9-13.pdf.

15. Ibid

16. Ibid

17. Auxier, Richard C. “States should answer a few questions before taxing e-cigarettes.” May 18, 2016. http://www.taxpolicycenter.org/taxvox/states-should-answer-few-questions-taxing-e-cigarettes

Find the printable PDF version of this report here!