The Idaho Legislature is responsible for allocating millions of tax dollars each year to support Idaho’s families, businesses, schools, and communities. Over the last several years, lawmakers have prioritized cutting taxes; thereby cutting state revenues and the dollars available to support important public goods and services. These series of tax cuts made Idaho’s tax system more regressive1 and direct more tax relief to wealthy households than those with low and moderate incomes. Lawmakers should prioritize providing targeted tax relief to families that need it the most, instead of wide sweeping cuts that disproportionately benefit the wealthy. The income tax relief measures approved by the Idaho Legislature in 2025 continued this tax cut trend. However, the 2025 tax cuts are expected to result in a tax increase in 2026 for most middle-income families with children if efforts are not taken to renew the state’s Child Tax Credit, which the legislature is allowing to sunset on December 31, 2025.2

Income Tax Cuts in House Bill 40 Make Idaho’s Tax Structure More Regressive

The Idaho Legislature passed $377 million in income tax cuts during the 2025 Legislative Session with House Bill 40 and House Bill 231.3 House Bill 40 made the state’s overall tax system more regressive — shifting more of the tax burden to Idaho’s middle-income families — by giving a greater share of income tax cut benefits to the wealthiest households. This bill cut the income tax rate from 5.695 to 5.3 percent, resulting in the top 20 percent of households – those with incomes of $146,700 and above – receiving 66 percent of the overall benefits. The top one percent of income earners will receive an average income tax cut of $5,358, while families earning a median income will receive an annual tax cut of approximately $127.

Enhancement of the Refundable Grocery Credit in House Bill 231 Provides Some Balance

House Bill 231 increases the grocery tax credit for all individuals from $120 to $155 per person in the household. Alternatively, Idahoans can receive a full refund of up to $250 for all grocery taxes paid by itemizing their grocery expenses. The grocery tax credit can be claimed on a tax filer’s income tax return and aims to offset the sales tax residents pay on groceries. It is known as a refundable tax credit because residents can receive the full value even if they do not owe any state income taxes, helping families with relatively low earnings pay for food.

The increase in the grocery tax credit acts as a small counterweight to help tip the scale back towards balancing the regressivity in Idaho’s overall tax code, but it is not enough to make a significant impact. Low to middle income families still pay a higher share of their income on taxes than high income families. The bottom 20 percent of households’ effective tax rate is 9.3 percent of their income, almost 2 percent higher than the top 20 percent of households’ effective tax rate of 7.4 percent of their income.4 For a further breakdown of effective tax rates by income group, see the chart below.

Expiration of the Child Tax Credit Increases Tax Burden on Middle-Income Families

Idaho lawmakers decided not to extend the state’s Child Tax Credit (CTC) as a part of the 2025 income tax relief package. The CTC is a tax incentive that provides tax relief to families with children. The credit is offered by the federal government and 16 states, including Idaho, to enhance the economic security of families with children. In fact, the credit is proven to be an effective tool for reducing poverty nationwide. Studies on the federal CTC found that in 2018, the credit lifted 4.3 million people ― including 2.3 million children ― above the poverty line. And in 2021, ninety percent of families with low incomes who received the expanded CTC used it to purchase necessities like food, pay utility bills, make rent or mortgage payments, buy clothing, and cover education costs.5

Idaho’s CTC came into effect on January 1, 2018, and will sunset on December 31, 2025, if legislative action is not taken. Idaho families currently receive $205 dollars for each qualifying child under the age of 17.6 Over a quarter of Idaho’s households benefit from the state CTC7, which gives back between $66-68 million to Idaho families each year.8

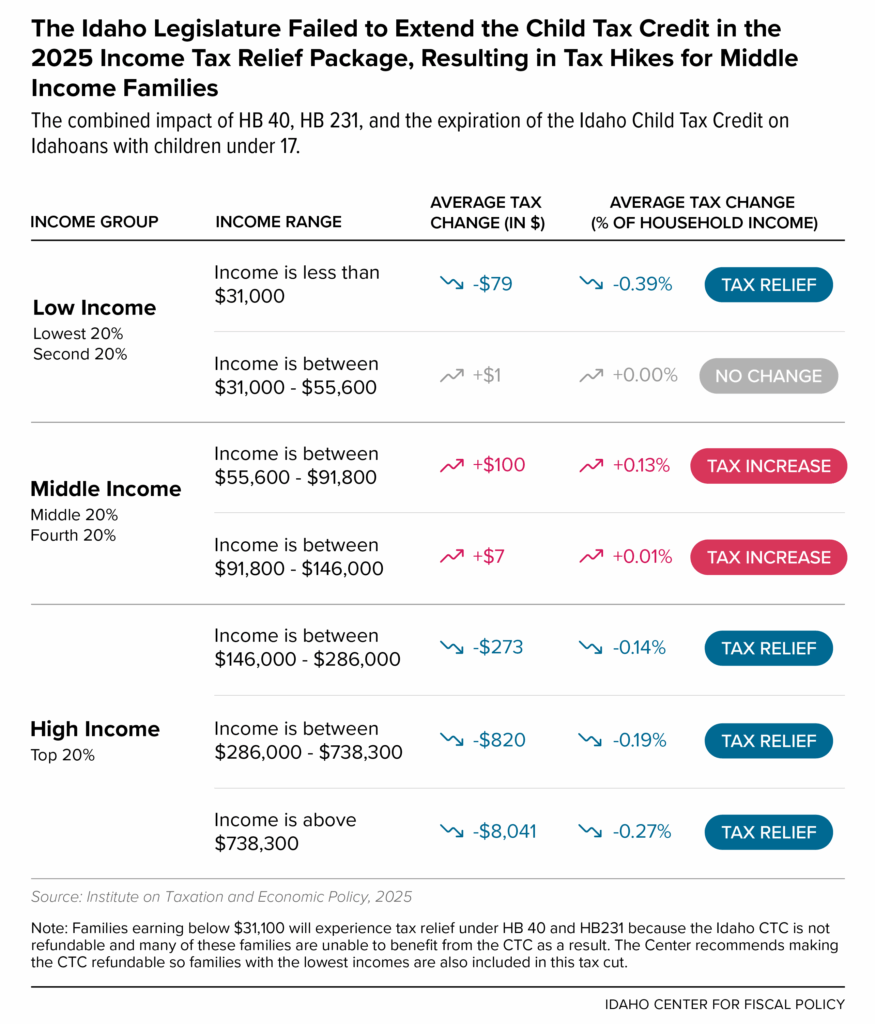

The decision to allow the state’s CTC to sunset, when taken into consideration alongside HB 40 and HB 231, will result in no income tax relief for most Idaho families with children next year. Specifically, families earning between $31,100 and $146,000 annually will not see any tax benefit, and families earning between $55,600 and $91,800 will experience an estimated annual income tax increase of $100.9

Policy Options for Lawmakers

Although Idaho Legislators left middle class families behind in their 2025 tax relief package, they can still make it right during the 2026 Legislative Session by renewing the Child Tax Credit. Lawmakers could also incorporate an income eligibility limit at around $146,000 AHI10 for the program to create savings while ensuring that families earning between $31,000 and $146,000 AHI will not experience an increased tax burden in 2026 and beyond.

Additionally, making the credit refundable would ensure families with the lowest incomes, earning less than $55,600 AHI, are eligible for this tax relief. Currently, Idaho’s CTC is non-refundable ― the credit can only reduce a family’s income tax liability to zero. This means that families that who owe little or nothing on their income taxes are not able to claim the full value of the credit, resulting in negligible benefits for families in the lowest income range.

For more information on the CTC and policy options for lawmakers, read our report at https://idahofiscal.org/the-child-tax-credit-provides-tax-relief-to-all-families-with-children/ .

Endnotes

- In regressive tax systems, low-income individuals pay a larger percentage of their income in taxes compared to high-income individuals. ↩︎

- Idaho Center for Fiscal Policy. “Child Tax Credit Expiration Will Lead to Tax Increase on Middle Income Families.” April 8, 2025. ↩︎

- Analysis by the Idaho Center for Fiscal Policy. The Center’s estimate differs from the fiscal notes in House Bill 40 and 231. The combined estimated cost of the fiscal notes is $290 million. For more, read our analysis on House Bill 40 and House Bill 231. ↩︎

- Institute on Taxation and Economic Policy analysis. ↩︎

- CBPP. “Policy Basics: The Child Tax Credit.” December 7, 2022. ↩︎

- Idaho State Statute. Title 63. Chapter 30. Section 63-3029L. ↩︎

- Center on Budget and Policy Priorities. “Program Participation Data Dashboard. EITC and CTC Claims.” February 14, 2024. ↩︎

- Idaho Division of Financial Management. “General Fund Revenue Book FY 25.” Pg. 26. January 8, 2024. ↩︎

- Idaho Center for Fiscal Policy. “Child Tax Credit Expiration Will Lead to Tax Increase on Middle Income Families.” April 8, 2025. ↩︎

- Annual Household Income ↩︎