An arrest in Idaho can result in individuals facing court-ordered fines and fees that jeopardize the financial stability of the individual, their family, and their community. The problem is so systemic that the Idaho Supreme Court recently ruled unanimously against the use of arrest warrants for unpaid fines and fees without considering ability to pay. The collection of fines and fees in Idaho is a widely used practice intended to (1) serve as a deterrent or punishment for individuals found to be in violation of Idaho law and (2) provide revenue to offset the cost of administering the justice system. Fines and fees function like a regressive tax that inflicts undue burden on Idahoans with low incomes and Idahoans of color, trap Idahoans in the legal system, contribute to increased public spending, and fail to boost revenue.

Fines and fees are a form of regressive tax that inflict undue burden on Idahoans with low incomes and people of color.

Fines and fees that fail to consider a defendant’s ability to pay inflict much greater burdens on people with low incomes than people with higher incomes. When faced with fees or fines that exceed their already limited budgets, Idahoans with low incomes are more likely to struggle to afford other necessities, like rent or car payments.

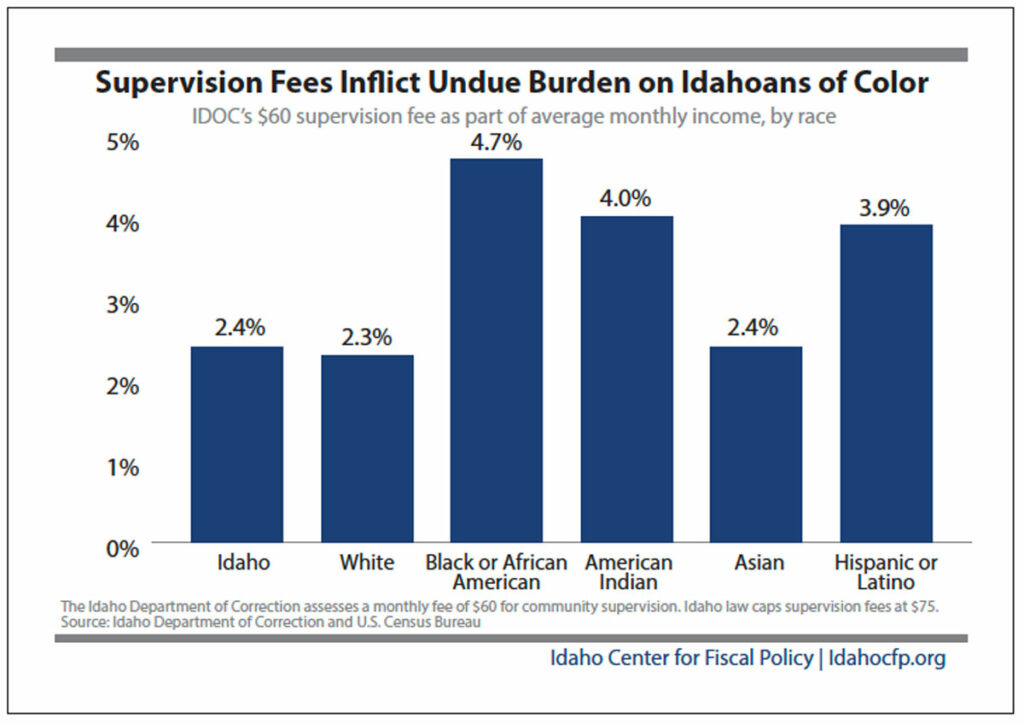

These inequities are even greater for Idahoans of color. Due to a history of racist policies, discrimination, and current bias, households of color experience lower income compared with white households and, therefore, fees and fines weigh more heavily. At the same time, Idahoans of color are more likely to be under the custody of Idaho’s Department of Correction.1 Policy choices should not fall harder on Idahoans of color than others, and addressing the effects of fines and fees can help us get back on track to rolling back high incarceration rates, recidivism, and supporting communities all over the state.

Although fine and fee assessments are codified in Idaho Statute, judges often have the discretion to waive or lower fines and fees due to inability to pay. As a result of this discretion, waivers are not guaranteed, uniformly applied, or granted based on standardized guidelines.2 This lack of standardization or use of best practices results in a system that is inconsistent, unpredictable, and subject to bias.

Additionally, a justice system that relies upon fines and fees to fund important court services is unfair in nature. Due to limited local budgets and revenue collection restrictions, there is no incentive for judges to waive fines and fees when individuals are unable to pay.

Fines and fees trap Idahoans in the criminal justice system and increase public spending.

Even with unpaid court debt in the millions of dollars, Idaho does not have an administrative process in place for writing off or waiving unpaid fines and fees. When Idahoans are unable to pay an assessed fine or fee, they can face additional monetary penalties, have their debts sent to collections, or have the unpaid amount withheld from their state tax returns.3

When fines and fees exceed their ability to pay, people with low or limited incomes can find themselves trapped in the criminal justice system. For Idahoans on probation or parole, unpaid fines and fees can result in arrest warrants or be labeled supervision violations. These violations can result in arrest or incarceration, which can lead to other costly consequences that far exceed the cost of the unpaid debt. For the impacted Idahoan, time spent in custody can result in loss of employment, income, or housing – all of which are critical to successful community re-entry and financial stability. Idahoans with criminal records are also more likely to experience employment discrimination – an experience often felt more heavily by Idahoans of color who already face additional barriers to employment. In June, the Idaho Supreme Court unanimously ruled against this punitive cycle, an acknowledgement of its harms. In the case, an Idaho woman working and earning $12 per hour was arrested for a misdemeanor punishable with a fine of up to $300. After identifying the woman as indigent, the judge ordered the woman to pay a reduced fine of $150 for the offense – in addition to court costs and lab fees – for a total debt of $639. Unable to pay – as documented extensively in the case – the woman spent more than a week in jail on two occasions over the course of a year.4 Jail costs far outweigh the fees and fines levied in this case, make it difficult for the person to continue to sustain a job and household, and do not ensure that services are properly funded.

Everyone bears the substantial costs of arrest or incarceration when Idahoans are brought into custody for failure to pay court debts. Idaho’s prison spending increased by over 200 percent in the last 25 years – one of the highest increases in the nation – and incarcerates people at higher rates than previous generations.5 Ensuring individuals are not incarcerated for unpaid fees and fines is one way to begin reversing these concerning trends, and cost-savings could bolster public spending in schools, roads and bridges, and other critical policy priorities.

Over reliance on fines and fees can also harm the quality of government services and public safety outcomes. More spending by law enforcement on fine and fee collection compared with other functions is linked to decreased likelihood of solving violent and property crimes. This effect can play an outsized role in smaller communities where law enforcement staff have broader roles that come with more flexibility in daily activities.6

Fines and fees fail to boost revenue effectively or consistently.

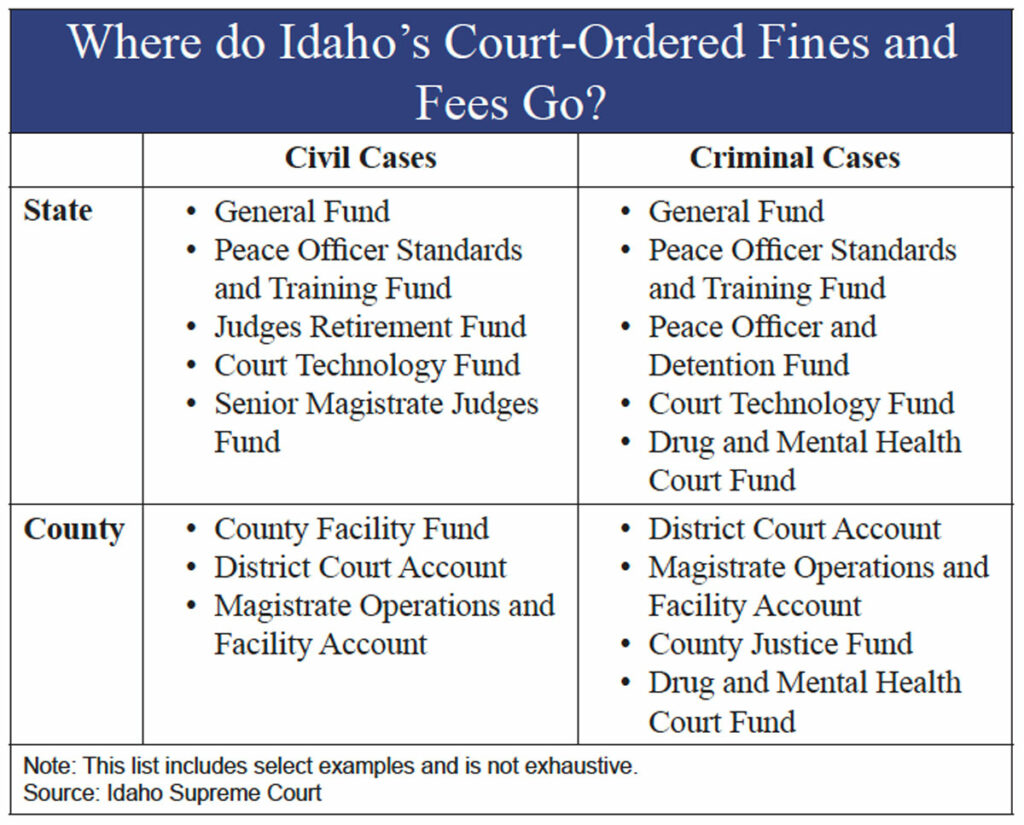

Idaho’s state and local governments rely on filing fees from civil lawsuits as well as fines and fees from criminal cases to offset the costs of administering the justice system. The courts distribute collected funds to state and local accounts as determined by Idaho law.

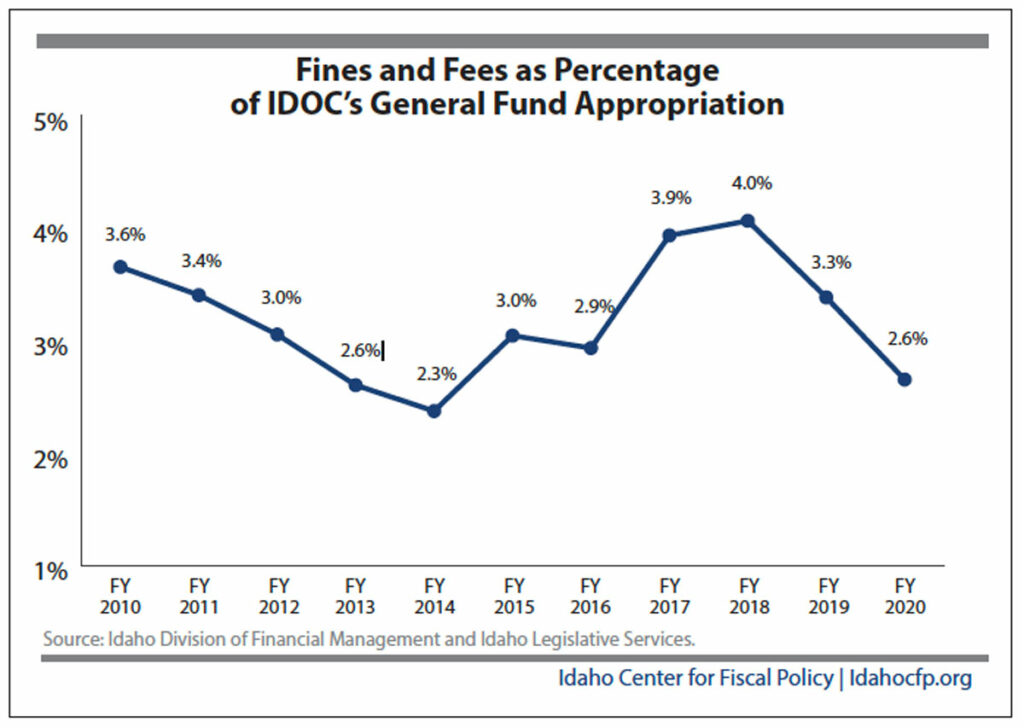

Much of the state’s fines and fees revenue supplements criminal justice spending from the General Fund, such as the Idaho Department of Correction (IDOC). However, revenue collected through fines and fees fluctuates significantly from year to year. Fines and fees made up less than 4.1 percent of IDOC’s General Fund allocation for the past 10 years and dropped below 3 percent four times in that same timeframe. The contributions from fines and fees are incidental to the overall IDOC budget, which is $310 million for FY 2022.7 8

Idaho’s counties also rely on revenue collected through fines and fees to offset the costs of operating the justice system and other government services at the local level. Compared to the state, fines and fees make up a larger proportion of funding in county budgets, which incentivizes their assessment and collection. Fines and fees revenue at this level also fluctuates significantly, making long-term budgeting decisions difficult.

Policy and Budget Solutions

Idaho’s current policies and procedures for the assessment and collection of fines and fees have many harmful drawbacks. However, Idaho lawmakers can address these inequities in the following ways:

- Re-examine statutes and practices related to the collection of fines within Idaho’s criminal justice system and standardize fair ability to pay guidelines.

- Draw on more state revenue to fund court costs in Idaho instead of fees.

- Enact equitable revenue solutions at the state and local level that ensure the tax load does not fall harder on working families, as it does now. Such tax policy choices include expanded grocery and child tax credits and a new credit that rewards earned income.

- Enact a local option tax or other ways to equitably raise local revenue that do not fall harder on households shouldering heavy property tax loads, such as aging households.

- Idaho Center for Fiscal Policy, “Reform Revisited: The Future of Criminal Justice in Idaho.” Winter 2020. Accessed at: https://idahofiscal.org/wp-content/uploads/2020/01/2020-01-14-ICFP-2019-Prisons-fact-sheet-FINAL2.pdf

- Idaho Office of Performance Evaluations, “Court-Ordered Fines and fees.” March 2019. Accessed at: https://legislature.idaho.gov/ope/reports/r1903/

- Idaho Supreme Court, “How are Delinquent Fines and Fees Collected?” Accessed at: https://courtdata.idaho.gov/stories/s/cti3-7ezq

- Cristina Mendez, Jeffrey Selbin, and Gus Tupper, “Blood from a Turnip: Money as Punishment in Idaho.” Idaho Law Review, Vol. 56, No.1, 2021. Accessed at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3841854 Ibid.

- Rebecca Goldstein, Michael Sances, & Hye Young You, “Exploitative Revenues, Law Enforcement, and the Quality of Government Services.” Urban Affairs, 2018. Accessed at: https://hyeyoungyou.files.wordpress.com/2018/08/finesandpolicing.pdf

- This analysis does not take dedicated and federal funding received by IDOC into account, meaning the impact to IDOC’s total budget is even less notable.

- 2021 Idaho State Legislative Session, “House Bill 262.” Approved March 19, 2021. Accessed at: https://legislature.idaho.gov/sessioninfo/2021/legislation/H0262/