The Child Tax Credit (CTC) is a tax incentive that provides tax relief for families with children. It is offered by the federal government and 16 states, including Idaho, to enhance the economic security of families with children, particularly those in low- to middle- income brackets. The Child Tax Credit puts money back into the pockets of hard-working Idahoans – empowering them to spend their money as they so choose- whether that is for additional educational supports for their children, groceries on the table, or gas in their vehicles.

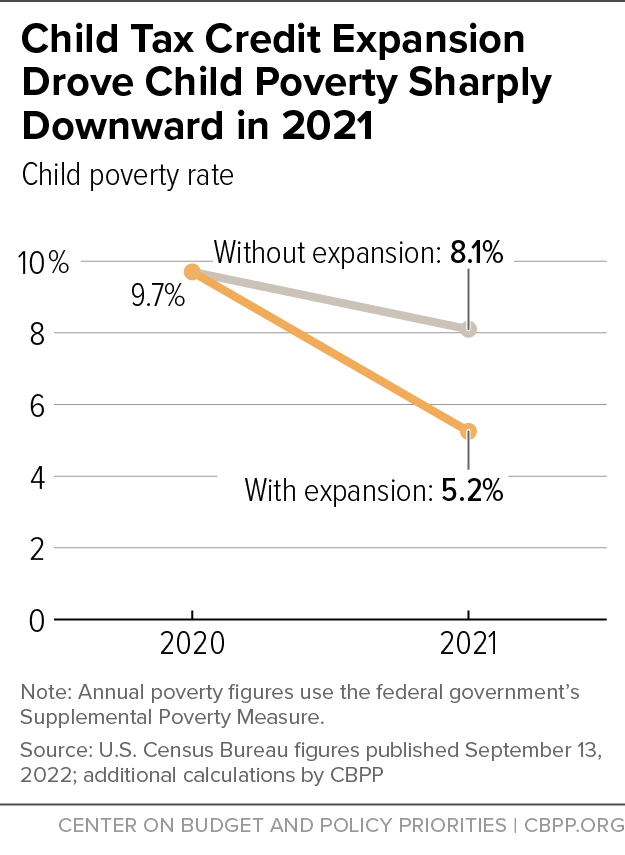

The Child Tax Credit is an effective tool for reducing poverty nationwide. In 2018, the CTC lifted 4.3 million people ― including 2.3 million children ― above the poverty line.

Ninety percent of people with low incomes who received this credit used it to purchase necessities like food, pay utility bills, make rent or mortgage payments, buy clothing, and cover education costs.1

Tax Relief for Families with Children is Set to Expire

Now is the time to ensure tax relief for families with children. The federal child tax credit amount is set to be cut in half, from $2,000 per child to $1,000 per child, at the end of 2025 due to the expiration of the Tax Cuts and Jobs Act. Additionally, Idaho’s state Child Tax Credit of $205 per child is also set to expire at the end of this year. With both the federal and state tax relief programs sunsetting, families will experience an additional strain on their household budgets.

The Idaho Child Tax Credit

Idaho has a non-refundable tax credit that began on January 1, 2018, and sunsets January 1, 2026. Families receive $205 dollars for each qualifying child who is under the age of 17.2 A nonrefundable credit means that people who owe very little or nothing on their income taxes are not able to claim the full value of the credit, resulting in negligible benefits for households in the lowest income range.

Policy Options for Lawmakers

Now is the time to act, as Idaho’s Child Tax Credit is set to sunset at the end of 2025. Over a quarter of Idaho’s households filed for the federal CTC in 2021, putting $757 million back into the pockets of Idaho families.3 Idaho’s current CTC credits between $66-68 million to Idaho families each year.4

The following policy options would give back an additional $49 to $51 million to Idaho families.

Option 1 increases the Idaho Child Tax Credit from $205 to $250 per child and makes the credit refundable. It would give $51 million back to Idaho families with most of the benefits going to Idaho households with annual incomes at or below $55,600.

Option 2 increases the Idaho Child Tax Credit from $205 to $275 per child with phaseouts and makes the credit refundable. Families would be eligible for the full amount of the $275 credit if their Modified Adjusted Gross Income (MAGI) is $100K for filing single/married filing separately, $200K for married filing jointly, and $150K for filing head of household. If a family’s MAGI exceeds those limits, the credit is reduced by $5 for every $10 of income above the threshold until it is phased out completely. This option would give $51 million back to Idaho families with most of the benefits going to Idaho households with annual incomes at or below $55,600.

Option 3 increases the Idaho Child Tax Credit from $205 to $1,200 per child with phaseouts modeled after the federal EITC5 and makes the credit refundable. This option would give $51 million back to Idaho families with nearly all of the benefits going to Idaho households with annual incomes at or below $55,600.

Endnotes

- CBPP. “Policy Basics: The Child Tax Credit.” December 7, 2022. ↩︎

- Idaho State Statute. Title 63. Chapter 30. Section 63-3029L. ↩︎

- See Appendix 1 for a map of the number of families that claimed the EITC by legislative district. ↩︎

- Idaho Division of Financial Management. “General Fund Revenue Book FY 25.” Pg. 26. January 8, 2024. ↩︎

- See Appendix 2 for more information on the Earned Income Tax Credit. ↩︎

- “The Earned Income Tax Credit (EITC): How It Works and Who Receives It.” November 14, 2023. The Congressional Research Office. ↩︎

Appendix 1

Appendix 2: What is the EITC?

The Earned Income Tax Credit (EITC) is a federal tax credit for low- and moderate-income working people that encourages and rewards work and offsets federal payroll and income taxes. The amount of the EITC depends on a recipient’s income, marital status, and number of children. As the figure below shows, the credit rises with earned income until reaching a maximum level and then gradually phases out at higher income levels.6 The EITC is refundable, meaning that if it exceeds a low-wage worker’s income tax liability, the IRS will refund the balance.