- Spending on Private School Vouchers Increases Over Time

- Private School Vouchers Are Especially Harmful to Rural Communities

- Private School Voucher Programs Can Lead to Tax Hikes

- What Could $360 Million Buy for Idaho’s Public Schools?

Public education funding levels matter. A high quality and equitable public education system that ensures all Idaho children have the opportunity to thrive requires consistent and robust investments. An Education Law Center report showed that increases in education funding led to improved academic results and positive long-term outcomes, such as higher wages and lower poverty rates.[1] Adequate public education funding is needed to provide Idaho students with the evidence-based and cost-effective services that have been shown to improve student outcomes.[2] Instead of funding private school vouchers, Idaho lawmakers should focus on fully funding the state’s public schools.

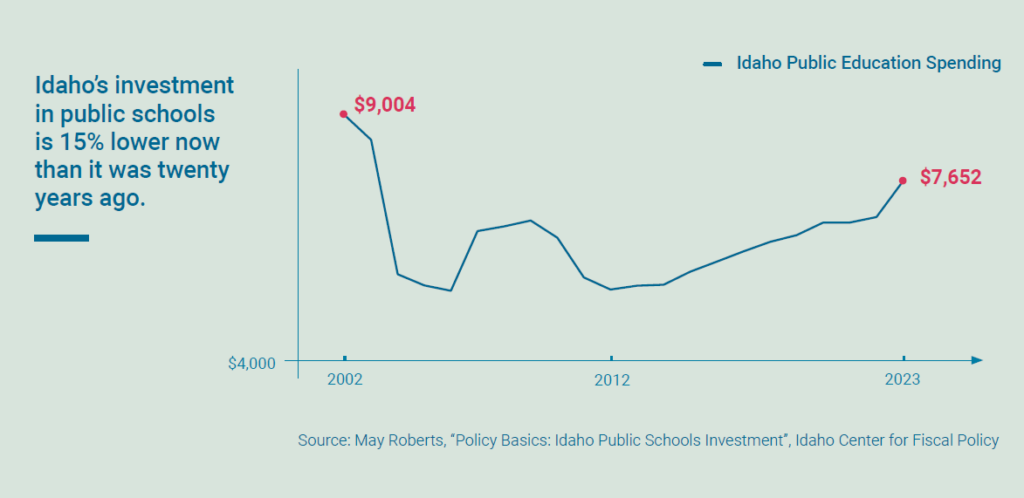

Idaho’s investment in public schools is lower now than it was twenty years ago.[3] The state has not recovered from cuts to the education budget following the Great Recession, yet numerous proposals to divert state resources to private school vouchers have been introduced in the Idaho State Legislature.[4] These efforts have failed so far. Enacting a voucher program in Idaho is likely to exacerbate public school funding shortfalls – hurting students, school districts, and communities as a result. Idaho should not spend limited taxpayer dollars on a second system of education that is expensive to operate, does not have fiscal transparency or oversight, and lacks the quality standards that apply to public schools.

Research shows states that enact private school voucher programs tend to funnel much greater amounts of public dollars to these programs over time, instead of investing in public schools, as legislators expand eligibility and create new programs, regardless of the success or popularity of existing programs. A Public Funds Public Schools (PFPS) report examining voucher spending in seven states from fiscal year 2008 through fiscal year 2019 found that each state dramatically increased its expenditure of public funds on voucher programs and also reduced efforts to fund public education. [5] See examples below:

Arizona

The PFPS report found voucher spending increased by 270 percent from 2008 to 2019, and per-pupil public education funding decreased by 5.7 percent during that time period.[6] The state’s education savings account voucher program, which now has universal eligibility, is projected to cost over $940 million per year. While the Legislature appropriated $624 million for the program in the 2024 budget, an increase of $150 million over 2023, an updated estimate puts the cost at almost $320 million higher. More than 50 percent of that is due to applicants who were already enrolled in private school or homeschooled. The updated figures show that 53 percent of all new K-12 education spending in fiscal year 2024 goes toward only 8 percent of Arizona students (those using vouchers). [7]

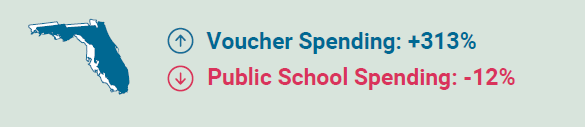

Florida

According to the PFPS report, Florida increased spending on voucher programs by 313 percent from fiscal year 2008 to 2019. [8] During the same period, the state decreased spending on public schools by 12 percent. Another report on voucher spending in Florida found that public school funds diverted annually to private education increased by approximately $1 billion between 2019-20 and 2022-23. [9] The state’s Empowerment Scholarship voucher programs cost $1.4 billion in the 2022-23 school year alone, [10] and nearly $1.1 billion in tax credits were offered to fund the state’s tax credit voucher program in fiscal year 2023. [11] Expansion of the Empowerment Scholarship vouchers to allow universal eligibility beginning in 2023-24 could bring the total cost of the program as high as $4 billion.[12]

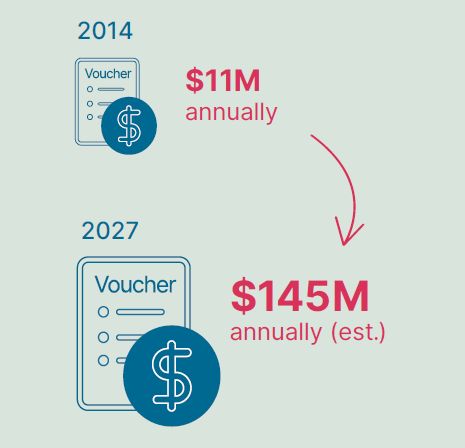

North Carolina

An analysis found that the North Carolina voucher program launched in 2014, which was initially limited to students with disabilities, has grown significantly since its enactment. The program was originally capped at $10.8 million per year, but funding more than doubled by 2016-17. Additional funding increases approved in 2016 are expected to bring the total to $144.8 million per year by 2027-28. The program was further expanded in 2020, which could increase costs by more than $270 million over the next ten years. [13] And legislation passed in late 2023 instituted universal voucher eligibility, meaning even the wealthiest families will now be able to take advantage of a private education subsidy.

This resource is a collaboration between the Idaho Center for Fiscal Policy, a nonpartisan organization committed to offering Idahoans high-quality fiscal research and analysis, and Public Funds Public Schools, a national campaign directed by Education Law Center to ensure that public funds for education are used to support and strengthen public schools.

[1] Mary McKillip & Theresa Luhm, Investing Additional Resources in Schools Serving Low-Income Students, Education Law Center (Apr. 2020).

[2] Education Law Center, Money Matters: Evidence Supporting Greater Investment in PK-12 Public Education: Research Talking Points for Advocates (Mar. 2023).

[3] May Roberts, Policy Basics: Idaho Public Schools Investment, Idaho Center for Fiscal Policy (Jan. 13, 2023).

[4] In 2023, these proposals included Senate Bills 1038, 1161, and 1144, as well as House Bill 289.

[5] Samuel E. Abrams & Steven J. Koutsavlis, The Fiscal Consequences of Private School Vouchers, Public Funds Public Schools (Mar. 2023).

[6] Id.

[7] Office of the Governor, Governor Katie Hobbs Statement on New School Voucher Cost Projections (July 25, 2023).

[8] Samuel E. Abrams & Steven J. Koutsavlis, The Fiscal Consequences of Private School Vouchers, Public Funds Public Schools (Mar. 2023).

[9] Mary McKillip & Norín Dollard, Florida’s Hidden Voucher Expansion: Over $1 Billion from Public Schools to Fund Private Schools, Education Law Center & Florida Policy Institute (2022).

[10] Florida Dep’t of Education, Florida Education Finance Program 2022-23, Fourth Calculation (Apr. 14, 2023).

[11] Florida Dep’t of Revenue, Florida Tax Credit Scholarship Program Tax Credit Cap Will Increase (2022), https://floridarevenue.com/taxes/tips/Documents/TIP_22ADM-05.pdf.

[12] Education Law Center & Florida Policy Institute, The Cost of Universal Vouchers: Three Factors to Consider in Analyzing Fiscal Impacts of CS/HB1.

[13] Kris Nordstrom, Legislative changes to voucher program will likely drain $272 million from NC over next decade, North Carolina Justice Center (Dec. 21, 2020).