Idaho’s students, families, and communities benefit when Idaho’s kids have access to high quality educational opportunities. However, Senate Bill 1025 diverts taxpayer dollars away from Idaho’s public school system to provide financial support to a select few Idaho students in a limited number of geographical areas – ultimately harming Idaho’s rural students and schools the most. Similar programs enacted across the country have consistently ballooned in cost over time to the detriment of public school funding.

These funds would be better spent on bolstering Idaho’s public education system statewide and providing support that benefits all Idaho children through an improved Child Tax Credit.

What is Included in Senate Bill 1025?

Senate Bill 1025 changes the Empowering Parents grant program to allow K-12 private education expenses to be subsidized with public funds. The cost of the program would be capped at $50 million annually. The program currently receives $30 million annually, so this would be a $20 million increase. Parents could claim a $5,000 grant per child they have enrolled in a non-public school with a cap of $15,000 awarded per household. Households that make an $80,000 adjusted gross income (AGI) or less would receive 95 percent of the grant awards. The bill also provides pre-K tuition and fees as an eligible expense in the Empowering Parents grant program and an increased $30 million investment into special education. Finally, the bill creates an Idaho Public Education Red Tape Reduction Program to streamline reporting requirements for schools.

The Education Choice & Competition Act Does Not Expand School Choice

The Education Choice & Competition Act would be funded at the expense of the public education system. Senate Bill 1025 is a school voucher program because it allows parents to use public funds to pay for their children’s private education through the Empowering Parents program, decreasing the funds available for needed investments in public education. Currently, Idaho ranks last in per pupil spending for the public schools that educate the majority of Idaho’s children. States that adopt similar programs greatly expand in costs over time.1 While the Empowering Parents expansion under this bill would sunset in 2030, the cost of the program could balloon to $246 million annually if the sunset clause and spending caps are removed by the legislature in the future.2

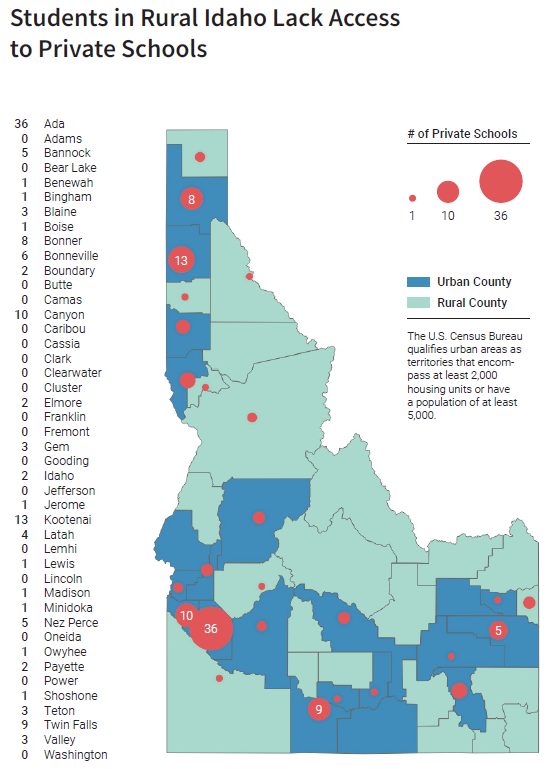

The Education Choice & Competition Act will not expand school choice for rural Idaho students. Nearly half of all counties in Idaho (20) do not contain a single private school, and only 22 percent of Idaho’s 121 private schools are in rural towns. Furthermore, rural towns in Idaho that do have a private school usually only have one. Most of the state’s private schools are in Ada County, where Idaho’s most populous city of Boise is located (see the map in Appendix 2 for the number of private schools in each of Idaho’s counties). Because private schools are concentrated in urban communities, a voucher program would divert rural tax dollars to subsidize payouts to private schools in Idaho counties that contain urban areas.3

The Education Choice & Competition Act Has Accountability Measures and Prioritizes Lower Income Families

Parents can only use the Empowering Parents grant program for tuition and fees on participating private K-12 schools. These schools must adhere to many of the requirements public schools have, such as special education laws like the Individuals with Disabilities Education Act, the Idaho Dignity and Nondiscrimination in Public Education Act, and the provisions of the Idaho Parental Rights in Education Act. They also must maintain and provide enrollment and performance data for eligible students as required by the Idaho State Department of Education, administer national achievement assessments, and perform criminal background checks on all individuals that have unsupervised contact with students.

The bill would also expand eligible expenses in the Empowering Parents program to allow pre-K tuition and fees for children three and older. Parents could only pay tuition and fees of participating pre-K providers and schools that are licensed by the Idaho Department of Health and Welfare and adhere to federal laws and regulations.

Most grant awards would be awarded to Idahoans with modest incomes. Seventy-five percent of the awards would be awarded to households at or below $60,000 AGI, 20 percent to households between $60,000 to $80,000 AGI, and 5 percent to households above $80,000 AGI. $80,000 AGI is 300 percent of the federal poverty level for a family of three.

Other Policy Considerations

Senate Bill 1025 would increase investment in special education by $30 million. The stated intent of this investment is to address the $66.5 million gap in special education funding to ensure that more money is directed to support students with special needs. The distribution to public school districts would be provided through the school funding formula.

An Idaho Public Education Red Tape Reduction Program would also be created in this bill. The stated intent of the program is to cut down on unnecessary or duplicative reports required by the state to save time and resources for school districts, allowing them to focus more on student needs. Going forward, schools would only need to submit reports required by federal law, with exceptions for new state programs.

Policy Recommendation: Fund Families, Not Private Schools, with a Child Tax Credit

Instead of benefitting only some families by allowing them to subsidize their children’s private education with taxpayer dollars, Idaho could make the state Child Tax Credit (CTC) refundable and create a state Earned Income Tax Credit (EITC) to enhance the economic security of low to middle income families. Together the efforts would cost $74 million ($29 million for the refundable CTC and $45 million for the EITC) and the programs would benefit approximately 80 thousand families. 4 The CTC and EITC puts money back into the pockets of hard-working Idahoans – empowering them to spend their money as they choose, whether that is for additional educational supports for their children, groceries on the table, or gas in their vehicles.

Endnotes

- Idaho Center for Fiscal Policy and Public Funds Public Schools. “Spending on Private School Vouchers Increases Over Time.” January 10, 2024. Spending on Private School Vouchers Increases Over Time – Idaho Center for Fiscal Policy (idahofiscal.org) ↩︎

- See Appendix 1 for the ICFP cost analysis of SB 1025. ↩︎

- Idaho Center for Fiscal Policy and Public Funds Public Schools. “Private School Vouchers Are Especially Harmful to Rural Communities.” January 10, 2024. Private School Vouchers Are Especially Harmful to Rural Communities – Idaho Center for Fiscal Policy (idahofiscal.org) ↩︎

- May Roberts. “Idaho’s Recent String of Income Tax Cuts Jeopardizes Investments in Public Services.” Idaho Center for Fiscal Policy. October 4, 2024. ↩︎

Appendix 1: Senate Bill 1025 Empowering Parents Expansion Cost Analysis

Estimates of the future cost of the expansion at the state level were made by multiplying the number of private school and public school students in Idaho by utilization rates based on studies conducted of similar existing programs to calculate the number of program participants. The number of participants was then multiplied by $5,000 to calculate the projected annual cost. The cost of the program may be more expensive than this estimate because the analysis was unable to estimate how many prekindergarten students would take advantage of this program.

Number of Students: The number of K-12 students in private school estimate is from the National Center for Education Statistics Private School Universe Survey data hosted on the Public Funds Public Schools webpage. The number of students in public school was found on the Idaho State Department of Education site under Midterm ADA 2024-2025.

Utilization Rate: The private school subsidy utilization rates are based on studies conducted of similar existing programs.

Number of Participants: The number of program participants was calculated by multiplying the number of students by the utilization rate.

Projected Cost: The projected cost was calculated by multiplying the number of participants by the $5,000 award amount stated in SB 1025.

Appendix 2: Map of Private Schools in Idaho