Find the full PDF version of ‘Investing in Public Education’ here.

In recent years, Idaho has established ambitious goals for our system of public education – goals designed to allow all students to achieve their full potential and to promote economic growth and prosperity for all of our state’s communities well into the future. At first glance, Idahoans seem to be investing less in educating Idaho students. Yet pressure has increased to make up the shortfall at the local level through property taxes.

Section 1 of this report addresses the decline in state funding over time and Section 2 examines how local tax levies are being used to compensate for this shortfall. The unintended consequences of these trends put some students at a disadvantage when it comes to academic achievement. Policymakers have taken steps in recent years to reverse disinvestment in education as Idaho has slowly recovered from the recession.

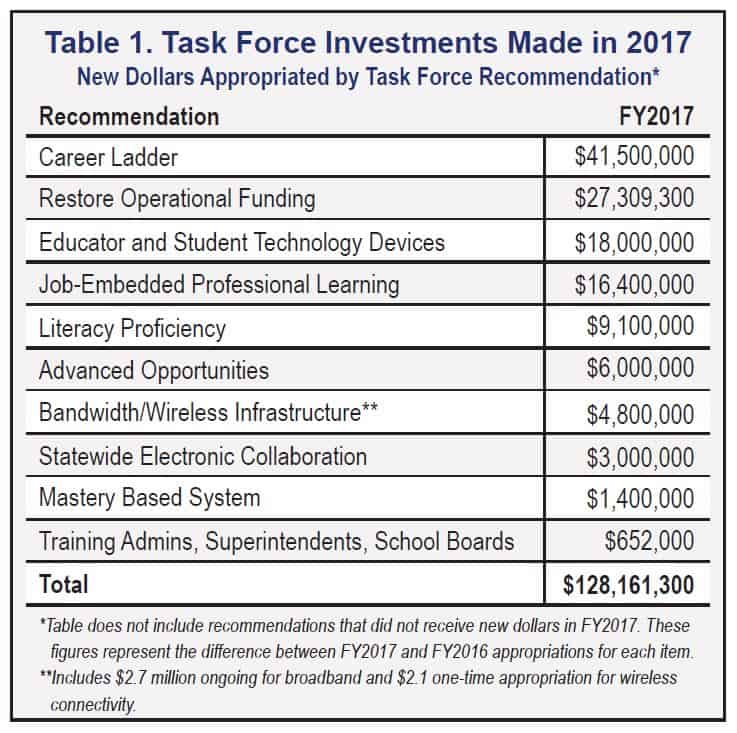

Additionally, the state has set bold, specific goals to improve student achievement. In Section 3 we evaluate the progress made towards recommendations issued in 2013 by Governor Otter’s Task Force for Improving Education and discuss further steps needed to put Idaho’s education system on track to meet our goals. A new federal administration in 2017 means federal funds that support traditional public and charter schools could change significantly, with implications for how much state investment will be needed to achieve our goals (page 3).

This report evaluates the extent to which the three funding sources for our public school system – state, federal and local – are able to provide the resources needed to achieve Idaho’s education policy goals over time. Our examination reveals three key findings in Idaho education funding:

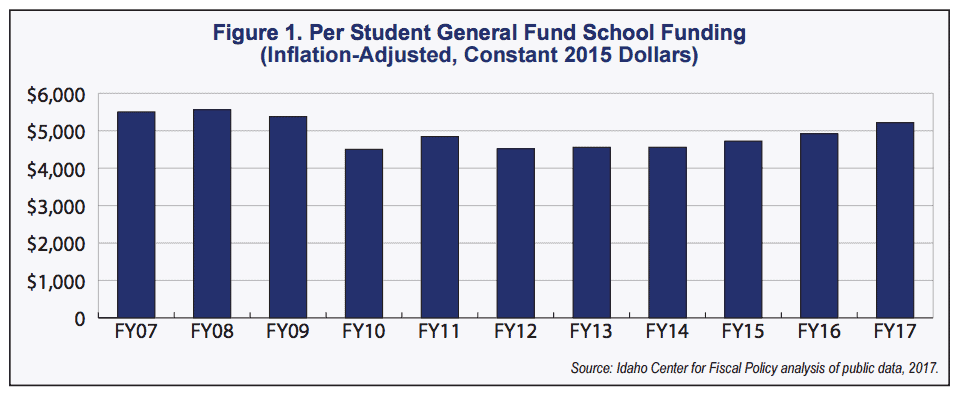

1. When adjusted for inflation and student growth, general fund support for public schools today is lower compared with 2008, despite efforts to rebuild funding in recent years (Figure 1).

2. There is increased reliance on supplemental property tax levies (1) at the school district level, resulting in increasingly divergent funding levels per pupil across the state (Figures 3, 4, and 5).

3. Despite recent gains, the state is only about halfway towards fully funding the policy improvements identified by a wide array of education stakeholders (Table 2).

Idaho General Fund Investments: A Dramatic Downturn and Recent Progress

In the past decade, state investment in public education dropped dramatically, stagnated, and then picked up again as stakeholders came together around shared policy priorities. Disinvestment was a reaction to weak economic performance during the economic downturn that began in 2009. But decisions about taxes and the state budget have also decreased or reallocated the dollars available to rebuild investment for education and other public services. The 2006 property tax swap replaced approximately $260 million in property taxes for schools with revenue from a 1% increase in the sales tax, which that year brought in $210 million. One analysis estimates the value of the eliminated property taxes in 2015-16 at $303.1 million (2). A 2012 reduction in the state’s top income tax rate from 7.8% to 7.4% reduced revenue by $35.7 million dollars (not adjusted for inflation).

In 2013 a new personal property tax exemption meant that General Fund dollars would be redirected to shore up local taxing districts’ revenue losses. After several years of policy choices in which lawmakers redirected resources, the economic recession hit the state in 2009, resulting in scarce years for all public services.

A disciplined legislative approach to funding Governor Otter’s Education Task Force recommendations has resulted in larger commitments to education in the past two years and continues to offer opportunities to strengthen education funding further. The 2017 General Fund budget continued the trend of reinvestment in education (refer to Table 1).

Governor Otter recommended $10.7 for a new literacy initiative, which was ultimately created with a $9.1 million investment in addition to the $2.1 being spent annually on literacy. This budget also made good on the Task Force recommendation to fund the second year of the teacher career ladder and to restore operational funding (3) to pre-recession levels in nominal terms (i.e. not adjusted for inflation).

Despite steadily increasing General Fund revenue since 2013 and targeted investments, funding for public schools has not returned to pre-recession levels. Inflation-adjusted funding for the public schools budget in fiscal year 2017 was $343 per student below 2008 levels (Figure 1).

Continue reading ‘Investing in Public Education’ in full PDF format here.