The state property tax reduction program, commonly known as the “circuit breaker” is a highly targeted and relatively low-cost tool that supports older and disabled Idahoans and widows who are the most affected during this time of soaring home prices. Unless lawmakers pass a legislative fix, many older Idahoans will be disqualified from the program. Last year’s House Bill 389 had unintended consequences, and could throw about 1,800 Idaho households off the program. The most financially modest households removed from the program would have to come up with about $1,300 that the program had previously taken off their property tax bill.

To solve this problem by widening circuit breaker eligibility requirements, separate legislators in the House and in the Senate have proposed two fiscally prudent bills: House Bill 481 and Senate Bill 1241, respectively. If one of these bills or a compromise piece of legislation passes, thousands of modest-income seniors will have a better chance of aging in place. Senate Bill 1241 is the most promising because additional seniors would retain their circuit breaker benefit.

House Bill 481 and Senate Bill 1241 Respond to Weaknesses in 2021 Property Tax Legislation

House Bill 389 made two significant changes to the circuit breaker program:

- It raised the maximum allowable credit amount from $1,320 to $1,500.

- It added a new eligibility requirement based on the value of the applicant’s home. In order to qualify, the value of the applicant’s home could not exceed 125 percent of the median assessed value for all homes in the applicant’s county. This new eligibility requirement applies to current recipients as well as new potential recipients, meaning some people are going to be thrown off the program in 2022.

Compared with other individual tax breaks, such as rate reductions, the circuit breaker program is relatively low-cost at $18.25 million in 2020.

While exact figures are not available for the number of recipients of either proposed bill who would be restored to the program, the more generous Senate Bill 1241 is the most promising because additional seniors would retain their circuit breaker benefit. Senate Bill 1241 would raise the eligibility requirement to 200 percent of the median assessed value of all homes in the applicant’s county. Raising the value to 200 percent is particularly helpful for seniors who reside in high growth areas such as Kootenai and Canyon Counties where many modest homes have very high assessed values. The bill sponsor estimates that the bill will cost approximately $1.3 million. Sponsors of the less expansive proposal, House Bill 481, anticipate that the cost of their bill will be slightly lower at $1.1 million. House Bill 481 would raise the cap from 125 percent to 150 percent of median assessed value in the recipient’s county or $300,000, whichever is greater.

Circuit Breaker Overview

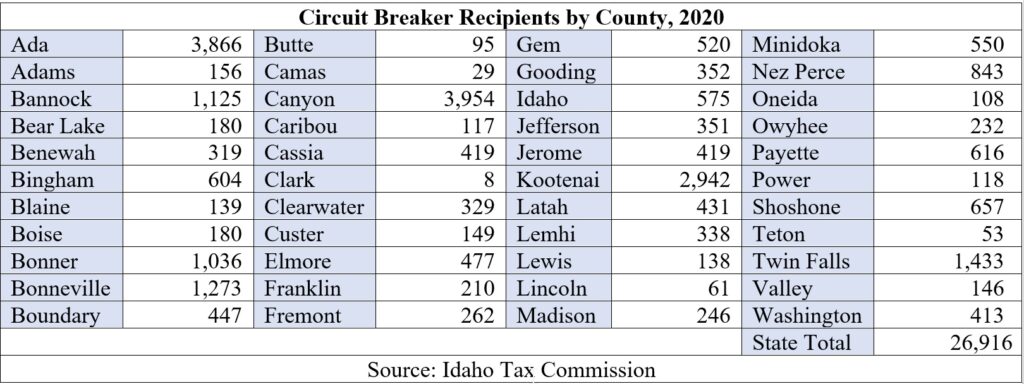

Idaho’s circuit breaker provides a property tax credit for homeowners whose property taxes consume a disproportionately large share of their income. Revenue from property taxes, both for real property and business personal property, support local public services – such as roads, courts, and schools. Property taxes are regressive, meaning they fall harder on lower-income Idahoans than others. The circuit breaker is available to seniors, people with disabilities, and widowed people whose incomes were less than $31,280 in 2020. Eighty-five percent of recipients are over the age of 65 and every county is represented (see the table below). The income thresholds are adjusted annually based on a formula tied to poverty guidelines and recipients can deduct unreimbursed medical expenses or insurance premiums from their income to qualify.