Read, download, and print this report in PDF form here.

The Idaho Legislature is considering a proposal that would cut top income tax and corporate tax rates. The bill will also eliminate the income tax on the first $750 of taxable household income.

This proposal would substantially reduce Idaho’s general fund revenue. Estimates of the impact range from $51 million to $56 million.[1] A majority of general fund spending (62.7% in fiscal year 2017) supports education.

The bill makes three main changes to Idaho’s tax system:

- A reduction to the individual income tax rate for the top bracket from 7.4% to 7.2%

- A reduction to the corporate income tax rate from 7.4% to 7.2%

- Elimination of the income tax on the first $750 of taxable household income

Proposal’s Impact on Idaho Taxpayers

Most Idaho households would not see a significant change in their tax bill from this legislation. Sixty-nine percent of households would see a tax cut, while 31% would see no benefit.[2]

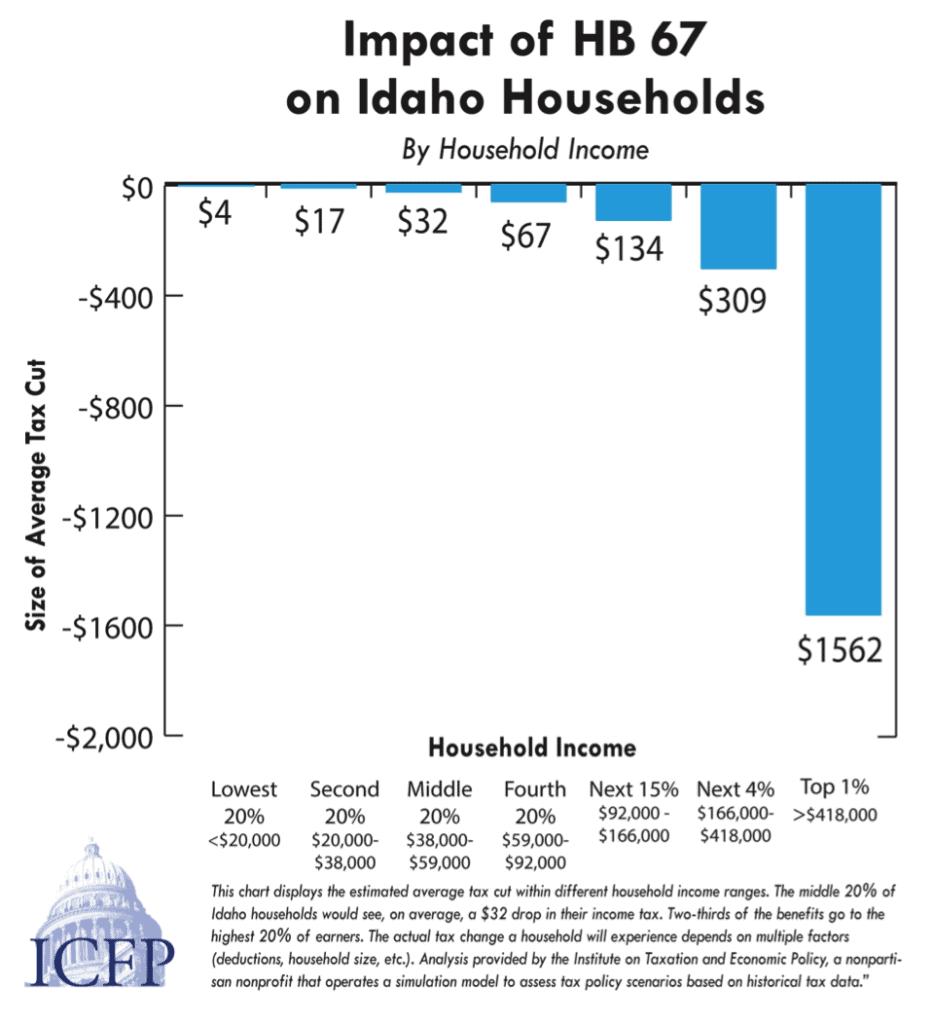

Idaho households with incomes between $38,000 and $59,000 a year would see a $32 decrease in their tax liability, on average. The top 1% – those with incomes of $418,000 and above – would see a $1,562 tax cut, on average.

This bill reduces general fund revenue by over $50 million. The top 20% of earners – those with incomes of $92,000 and above – would receive 67% of the monetary benefit; the remaining 33% of the benefit will be spread out among the 80% of Idaho’s households whose incomes are below $92,000.

Notably, the benefit of the reduction in corporate income taxes will largely accrue out of state with 81% flowing outside of our borders and 19% going to Idaho households that own stakes in companies that pay Idaho corporate income taxes.

See chart below for the average tax cuts from the bill within different income ranges.

Idaho’s Current Budget Context

Idaho lawmakers face multiple pressures when it comes to tax policy. Former Department of Commerce Director, Jeff Sayer, cautioned against further tax cuts and has encouraged increased public investments to develop a pipeline of talented workers. Businesses looking to expand in Idaho or relocate to our state have expressed deep concerns about meeting their workforce needs and expressed little interest in tax rates.[3] Similarly, business leaders, legislators, and education experts participating in the Governor’s Task Force for Improving Education have recommended a list of priority investments with a total price tag of about $480 million, $277 million of which remains to be addressed.[4] Other competing priorities for general fund revenue include strengthening our public defense system, addressing unmet healthcare needs, and narrowing gaps between state employee compensation and market rates. At the same time, some Idaho business groups are lobbying for cuts to income taxes and increases to the personal property tax exemption, both of which would reduce revenues available for education and other services.

Idaho’s total tax collections per person are relatively low, at 48th in the country, and 11th among the eleven Western states.[5] In a 2016 national ranking for economic climate, Idaho excels in the Cost of Doing Business category at 6th in the nation, which includes taxes. That same ranking puts Idaho at 49th for Education, 34th for Technology & Innovation and 28th for Workforce.[6]

Over the past decade, economic conditions and revenue-reducing policies have led to lower general fund collections when we adjust for inflation and even lower levels when we look at revenue in per capita terms. For example, in 2007 Idaho collected $2,166 per capita. That figure decreased to $1,891 in 2016 (using consistent inflation-adjusted dollars). Thus, when adjusted for inflation, per capita general fund revenues for fiscal year 2016 were only 87% of revenues from fiscal year 2007.

Idahoans’ Attitudes on Tax and Budget Policy

Public polling conducted in December, 2016 revealed high levels of satisfaction among Idahoans of our current tax system. Most Idahoans (65%) believe taxes in Idaho are about right, compared to 22.6% who say they are too high and only 9.1% who think they are too low.[7]

When Idahoans were asked what should be done with the state’s budget surplus:

- 46% said it should go to fund public education,

- 24% said it should be go to our rainy day fund,

- 17% think it should be invested in road and bridge improvements in Idaho, and

- 9% thought it should be the basis for tax cuts.[8]

Conclusion

No taxpayer wants the state to collect more in taxes than is needed for efficient and cost-effective public investments in schools, higher education, and other services that protect Idaho residents and fuel economic growth. The Legislature will have to choose between the competing priorities of education investments, increasing rainy day funds in preparation for the next recession, and its desire to cut the top income and corporate tax rates.

These decisions have important impacts in terms of the state’s ability to make key public investments today and the long-term stability of state finances—in both good times and bad.

Notes

[1] The bill’s fiscal note reports an estimate reduction in general fund revenue of $51.2 million. The Institute on Taxation and Economic Policy reports an impact of $56 million.

[2] In Idaho, 14% of Idaho’s households do not file state income taxes and 17% already receive the maximum benefit of refundable credits and would see no further benefit from the rate reduction. These households do pay property, sales, and gas and other excise taxes. Analysis provided by the Institute on Taxation and Economic Policy.

[3] Dentzer, B. (2015, October 6). Tax cuts? Top state business official tells lawmakers: ‘Not today.’ Idaho Statesman. Available at: http://www.idahostatesman.com/news/politics-government/state-politics/article40650972.html

[4] Idaho Center for Fiscal Policy, “Investing in Public Education.” January, 2017. Available at: https://idahofiscal.org/wp-content/uploads/2017/01/ICFP-Education-Report-2017-FINAL1.pdf

[5]Idaho State Tax Commission, “State and Local Tax Burden Analysis Executive Summary, FY2014 Taxes.” Available at: https://tax.idaho.gov/reports/EPB00074_12-22-2016.pdf

[6] America’s Top States for Business 2016: A scorecard on state economic climate (CNBC). Available at: http://www.cnbc.com/2016/07/12/americas-top-states-for-business-2016-the-list-and-ranking.html

[7] Boise State University School of Public Service. Second Annual Idaho Public Policy Survey, 2017. Available at: https://secureforms.boisestate.edu/sps/surveys/

[8] Ibid.