Grocery Tax Credit: Frequently Asked Questions

Policy Perspective

In recent years, Idaho lawmakers have debated eliminating the grocery tax credit (also known as the grocery credit), considering it along with the exemption of groceries from the sales tax. Over the last two decades, the grocery tax credit has been revised to expand its access and increase the credit value. Policymakers and the public should take into account considerations outlined in this document about the grocery tax credit and the important role of the sales tax on groceries in Idaho’s revenue and budgeting.

1. What is the Grocery Tax Credit?

The grocery tax credit is a refund for Idahoans. Its purpose is to offset some or all of the amount of sales tax that residents pay on groceries. It is known as a ‘refundable’ tax credit because residents can receive the full value even if they do not owe any state income taxes. The credit helps families with relatively low earnings pay for necessities.

2. How much is the grocery tax credit worth?

The tax credit is $100 per individual. Idahoans aged 65 and older receive an additional $20. This means a family of two adults and three children receives a tax credit of $500, while an elderly couple would receive a credit of $240. Individuals who do not file a tax return because their income doesn’t meet the threshold for filing may claim the full amount of the credit using a Form 24.

3. Are all Idahoans eligible for the grocery tax credit?

No. While Idahoans of any income level are eligible to claim the credit, participation in the Supplemental Nutrition Assistance Program (food stamps or SNAP), reduces or eliminates the credit. Idahoans who receive SNAP benefits are not eligible to claim the grocery tax credit for the months in which they receive benefits (the credit is prorated equally for each month). For example, a family of five that received food stamp benefits for four months during a year would see its tax credit reduced from $500 to $333.

People who are incarcerated are eligible for the credit only in the months they are not serving a sentence.

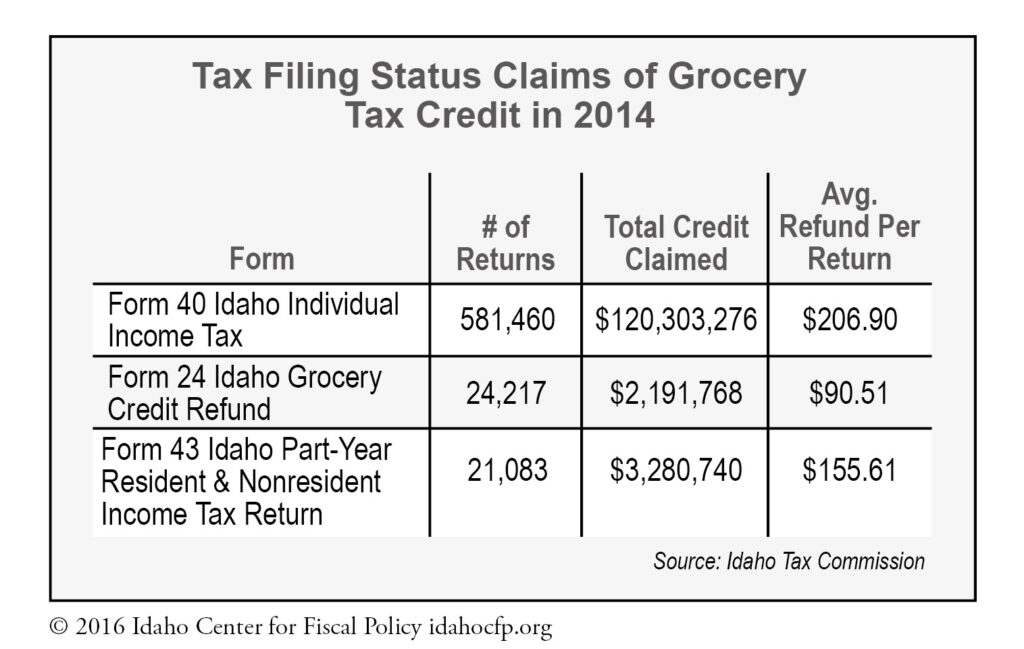

Partial-year residents of Idaho are eligible to claim a refund for the months they reside in the state using a Form 43. In 2014, Idahoans claimed the credit in three different ways based on filing status (see table).

4. What is funded with revenue from the grocery portion of the sales tax?

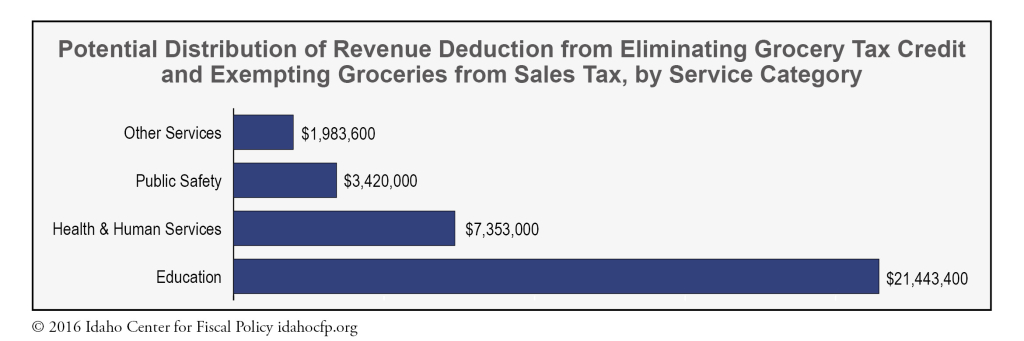

The majority of sales tax revenue goes to the General Fund, and a smaller share is distributed to local government. Education represents the biggest slice of General Fund expenditures at 63%, with Health & Human Services and Public Safety a distant second and third.

5. How would the elimination of the sales tax on groceries and the grocery tax credit impact the General Fund and education funding?

Information is not collected in Idaho on which sales are attributable to groceries, so revenue from grocery sales must be estimated based on consumer behavior. Overall, the cost to Idaho for making the grocery tax credit available is substantially smaller than the revenue collected on grocery purchases in the state. If the grocery sales tax and the grocrery tax credit were eliminated, Idaho would forego $56 million in total revenue, after accounting for the amount of grocery tax credits transferred to residents.1 Of that amount, an estimated $34.2 million in revenue would be deducted from the General Fund and would necessitate either increases in other taxes such as income and property taxes or a reduction in services such as public and charter schools or public health and safety. If $34.2 million fewer funds were available among different areas of the state budget at current proportions (see figure below), money for public and charter schools would be reduced by $21.5 million – more than twice the funds allocated for the state’s new literacy initiative, for example.

6. How would exempting groceries from sales tax and ending the grocery tax credit impact Idaho family budgets?

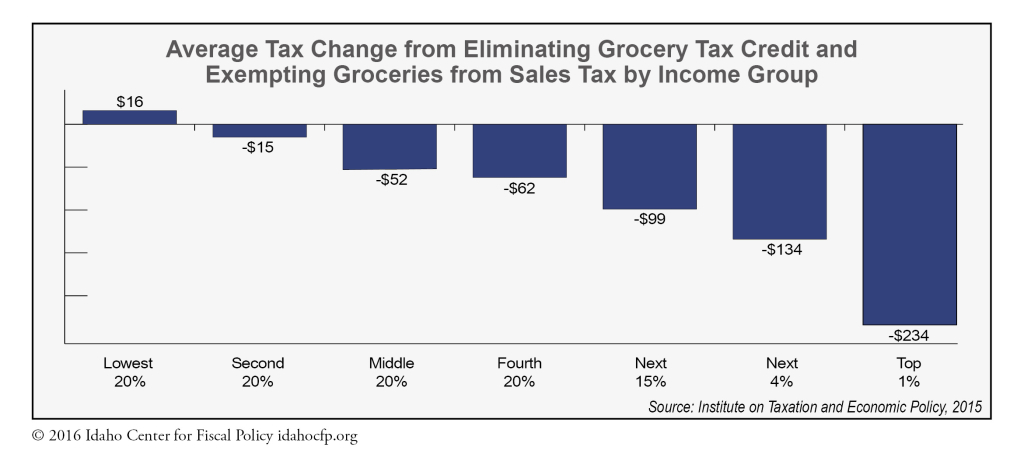

Households that purchase pricier groceries would reap a disproportionate share of the benefits because

the reduction in sales tax paid is directly related to how much one spends on groceries. Idahoans in the top 5% of earners who are likely to buy costlier food in more expensive stores would see tax reductions of over $100 per household, on average (see figure below). Middle-income Idaho households would see an average reduction of $52. Idahoans with very low grocery budgets would probably not see any financial benefit from eliminating the sales tax on groceries and the tax credit, and in fact could see their overall taxes paid increase slightly.

7. Are there any benefits to taxing groceries?

Yes. Because groceries are purchased year-round and the overall amount is fairly stable even as the economy ebbs and flows, the revenue from the sales tax on groceries is relatively predictable and makes state budgeting more reliable. The sales tax on groceries also brings in revenue from out-of-state individuals passing through or vacationing in Idaho.

8. At what point does the average Idaho family pay more in tax than they receive in credit?

Under our current system, a family of five receives less in tax credit than they pay in taxes when they spend more than $8,335 per year on groceries, or $695 per month. An elderly couple breaks even when they spend $4,000 per year on groceries, or $333 per month.

9. How does Idaho’s system compare to other states?

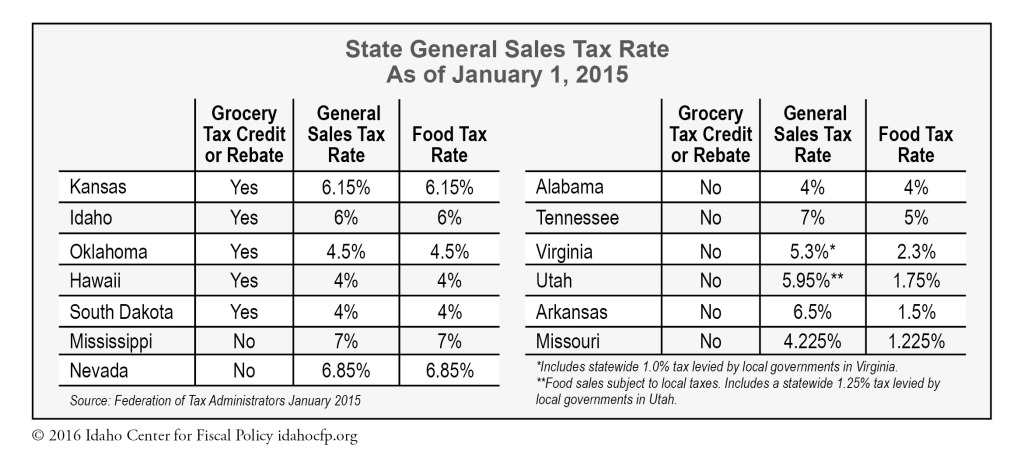

Idaho is one of five states – listed below – that tax groceries at the regular sales tax rate and offer some form of full or partial rebate or refund. An additional eight states levy sales tax on groceries, and of those, five have a reduced tax rate for groceries compared with other sales transactions (Tennessee, Virginia, Utah, Arkansas, and Missouri). Thirty-three states with sales taxes (including Washington DC) exempt food from taxation. The remaining five states do not have a sales tax.

10. Are there other tools available to reduce taxes for Idahoans who earn low incomes?

Some have expressed an interest in the sales tax/grocery tax credit swap as a way of putting more money into the pockets of Idahoans who struggle to make ends meet. If the goal is to reduce the taxes paid by Idahoans while disproportionately benefiting low-income Idahoans, the tax credit could be increased to a higher amount for all Idahoans or for those in lower income brackets. Alternatively, or in addition to this approach, the credit could also be tied to inflation in the cost of food, ensuring its value to all Idahoans from year to year.

Footnotes

1. Institute on Taxation and Economic Policy analysis, 2016.

Further Reading:

“Grocery Tax Exemption Is No Improvement for Idaho,” 2015. Institute on Taxation and Economic Policy, February 15, 2015, http://itep.org/itep_reports/2015/02/grocery-tax-exemption-is-no-improvement-for-idaho.php#.Vyejcmz5NPY

Income Tax Law Chapter 63-3024A: Food Tax Credits and Refunds

Income Tax Rule 771 Grocery Credit: Taxable Years Beginning After December 31, 2007 [PDF], p. 139.

“State Sales Tax on Groceries a Lose, Lose, Lose Proposition: Study,” 2016, http://www.nbcnews.com/business/taxes/state-sales-tax-groceries-lose-lose-lose-proposition-study-/n499746

“General Fund Revenue Book,” 2014, http://dfm.idaho.gov/publications/eab/gfrb/GFRB_FullDocument_Jan2014.pdf. p. 73.

Click here to find the printable PDF version of this FAQ Report