House Bill 447 creates a refundable tax credit and a grant program that allows private education expenses to be subsidized with public funds. Although the cost of the program is capped at $50 million in each of the bill’s first two years, language in the bill directs the legislature to “review and evaluate whether the annual maximum amount is appropriate to address the needs of the program” in 2026 – meaning the program could be expanded as early as 2026.[1] Other states that have adopted similar programs have experienced significant increases in cost over time.[2]

The potential annual cost to Idaho taxpayers from HB 477 is $170 million in 2026 and beyond.

Estimates of the future cost of this program at the state level were made by first, calculating the number of tax units [3] that have children in private and public school and the number of tax units that are eligible for the Earned Income Tax Credit. Second, the number of tax units were multiplied by enrollment rates based on studies conducted of similar existing programs to calculate the number of participants. The analysis assumes that the cap on the grant program would remain in future years. Finally, the number of participants was multiplied by $5,000 to calculate the projected annual cost. The cost estimate is conservative because the analysis was unable to estimate the number of children with disabilities that would take advantage of the program. See the Appendix for more detail.

What’s Included in HB 447?

Under House Bill 447, the cost of the refundable Idaho Parental Choice Tax Credit would be capped at $40 million annually, serving about 8,000 Idaho students. The credits would be available on a first-come, first-served basis, with the $5,000 credits going to the first taxpayers whose returns are properly filed. Parents or guardians with children with disabilities are eligible for a bolstered amount of $7,500. The credits could be used to reimburse parents or guardians for kindergarten through twelfth grade private education expenses including tuition and fees, nationally standardized assessments, textbooks, curriculum, and other educational materials.

The Idaho Parental Choice Grant could be used by parents and guardians with modest incomes to pay for the expenses involved in moving their public school student into private school. If parents or guardians are awarded the grant and enroll their child in private school, they may also claim the Idaho Parental Choice Tax Credit in the same year. The cost of the Idaho Parental Choice Grant would be capped at $10 million annually, serving about 2,000 Idaho students. Parents or guardians would be eligible for the grant if they qualify for the Earned Income Tax Credit (a tax break for low- to middle-income families). The grants would be available on a first-come, first-served basis, with the $5,000 grants going to the first eligible applicants. Applicants that have children with disabilities are eligible for $7,500.

School voucher tax credits and grants for private school are expensive, unaccountable, and do not expand school choice.

House Bill 447 is a school voucher program because it allows families to use public funds to pay for their children’s private education through refundable tax credits and grants, decreasing the funds available for needed investments in public education. States that adopt programs like these tend to expand them over time. [4]

The Idaho Parental Choice Tax Credit program does not effectively expand school choice for those that cannot afford private school. The grant portion of the bill makes an effort to assist families with modest incomes by establishing means-testing, eligibility determined by whether parents or guardians are eligible for the Earned Income Tax Credit (a tax break for low- to middle-income families). However, the Idaho Parental Choice Tax Credit is made available to all families that have children enrolled in private school, whether or not they can already afford it. The first-come, first-served nature of the Parental Choice Tax Credit also does not ensure students with the greatest financial need are guaranteed to receive assistance.

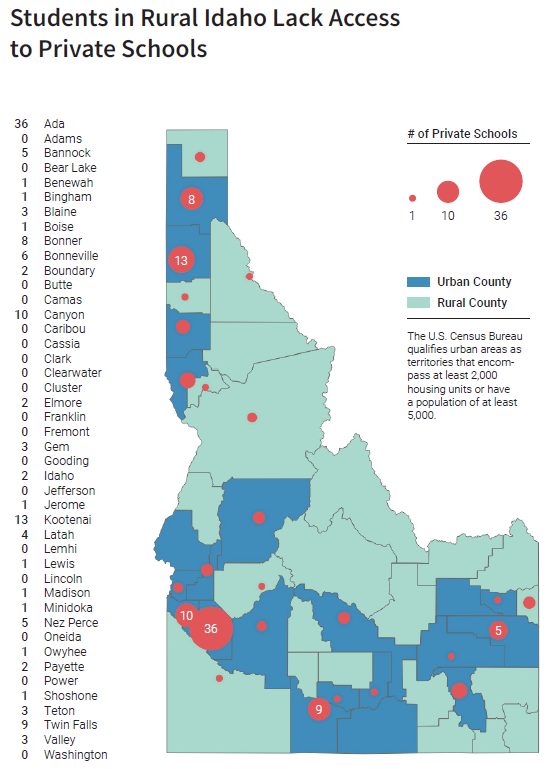

Additionally, providing school voucher tax credits and grants will not expand school choice for rural Idaho students. Nearly half of all counties in Idaho (20) do not contain a single private school, and only 22 percent of Idaho’s 121 private schools are in rural towns. Furthermore, rural towns in Idaho that do have a private school usually only have one. Most of the state’s private schools are in Ada County, where Idaho’s most populous city of Boise is located (see the map for the number of private schools in each of Idaho's counties). Because private schools are concentrated in urban communities, a voucher program would divert rural tax dollars to subsidize payouts to private schools in Idaho counties that contain urban areas.[5]

The Idaho Parental Choice Grant program is unaccountable. Private schools would not become subject to the same requirements public schools are expected to meet. Public schools are required to admit every student and be transparent about their finances and operations, while the bill does not require any sort of disclosure from private schools about their finances, how they operate, or how they measure student achievement. The bill states, “a nonpublic school shall not be required to alter its creed, practices, admissions policy, or curriculum.” [6]

Appendix: HB 447 Cost Projection for FY 2026 and Beyond

Number of Tax Units: The tax credit and the grant in HB 447 are awarded by tax unit. The number of tax units by school type for public school and private school was calculated by dividing the number of private [7] and public-school children [8] in Idaho by the total number of school age children in Idaho [9] to calculate an enrollment rate, then the corresponding enrollment rate was multiplied by the number of tax units with children.[10] The number of tax units that would be eligible for the grant was calculated by multiplying the number of tax units that filed for the EITC by the percentage that have children.[11]

Utilization Rate: The private school subsidy utilization rates are based on studies conducted of similar existing programs.[12] The analysis assumes that the grant program will be capped at $10 million, serving approximately 2,000 students.

Number of Participants: The number of program participants was calculated by multiplying the number of tax units by the utilization rate.

Projected Cost: The projected cost was calculated by multiplying the number of participants by the $5,000 award amount stated in HB 447. The analysis assumes that the grant program will remain capped at $10 million.

[1] Idaho Legislature. “H0477 – Seventy Seventh Legislature (2024): Idaho Parental Choice Tax Credit.” January 30, 2024. HOUSE BILL 447 – Idaho State Legislature

[2] Idaho Center for Fiscal Policy and Public Funds Public Schools. “Spending on Private School Vouchers Increases Over Time.” January 10, 2024. Spending on Private School Vouchers Increases Over Time - Idaho Center for Fiscal Policy (idahofiscal.org)

[3] Tax units are individuals, or married couples that file taxes together, along with any dependents they declare.

[4] Idaho Center for Fiscal Policy and Public Funds Public Schools. “Spending on Private School Vouchers Increases Over Time.” January 10, 2024. Spending on Private School Vouchers Increases Over Time - Idaho Center for Fiscal Policy (idahofiscal.org)

[5] Idaho Center for Fiscal Policy and Public Funds Public Schools. “Private School Vouchers Are Especially Harmful to Rural Communities.” January 10, 2024. Private School Vouchers Are Especially Harmful to Rural Communities - Idaho Center for Fiscal Policy (idahofiscal.org)

[6] Idaho Legislature. “H0477 – Seventy Seventh Legislature (2024): Idaho Parental Choice Tax Credit and Grant.” January 30, 2024. HOUSE BILL 447 – Idaho State Legislature

[7] United States Census Bureau. “B14002: Sex by School Enrollment by Level of School by Type of School for the Population 3 Years and Over: 2022 ACS 5 Year Estimates.” Accessed January 31, 2024. B14002: Sex by School Enrollment by ... - Census Bureau Table

[8] State Department of Education. “Full Term ADA Historical: 2022-2023.” Accessed January 31, 2024. Public School Finance / Departments / Idaho Department of Education

[9] United States Census Bureau. “S0101: Age and Sex: 2022 ACS 5 Year Estimates.” Accessed February 5, 2024. S0101: Age and Sex - Census Bureau Table

[10] Center on Budget and Policy Priorities. “Program Participation Data Dashboard: CTC – Estimated Characteristics of Tax Units Eligible for American Rescue Plan CTC.” Program Participation Data Dashboard (cbpp.org)

[11] Center on Budget and Policy Priorities. “Program Participation Data Dashboard: Idaho EITC – Claims and Estimated Characteristics of Eligible Filers.” Program Participation Data Dashboard (cbpp.org)

[12] Norin Dollard and Mary McKillip. Florida Policy Institute. “Estimating Florida’s HB1 Universal Voucher Cost in First Year.” February 14, 2023. 63dbbf721552bc04f0e63941_Estimating Florida Universal Voucher Cost (2).pdf (webflow.com)