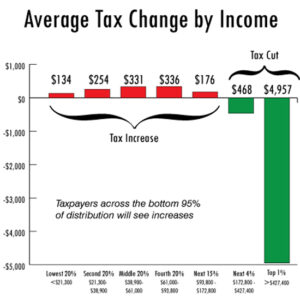

A new proposal in the Idaho Legislature would dramatically shift the way taxes are collected and generate a new revenue source for our neglected roads and bridges. The proposal has several components which in combination mean that taxpayers across the bottom 95% of the distribution will pay more, on average.

Read our Analysis of the New Tax Proposal

The Idaho Legislature’s 2025 Income Tax Relief Package Left Middle-Income Families Behind

- The Idaho Legislature is responsible for allocating millions of tax dollars each year to support Idaho’s families, businesses, schools, and communities. Over the last