The Idaho Legislature passed over $290 million in income tax relief during the 2025 Session. The relief came from House Bill 40, which lowered the income tax rate from 5.695% to 5.3% and House Bill 231, which increased the refundable grocery tax credit from $120 to $155 per person in a household.

However, the legislature failed to include a renewal of the state’s Child Tax Credit which expires at the end of 2025. The Child Tax Credit is a tax incentive that provides tax relief for families with children. It is offered by the federal government and 16 states, including Idaho, to enhance the economic security of families with children, particularly those in low- to middle- income brackets.

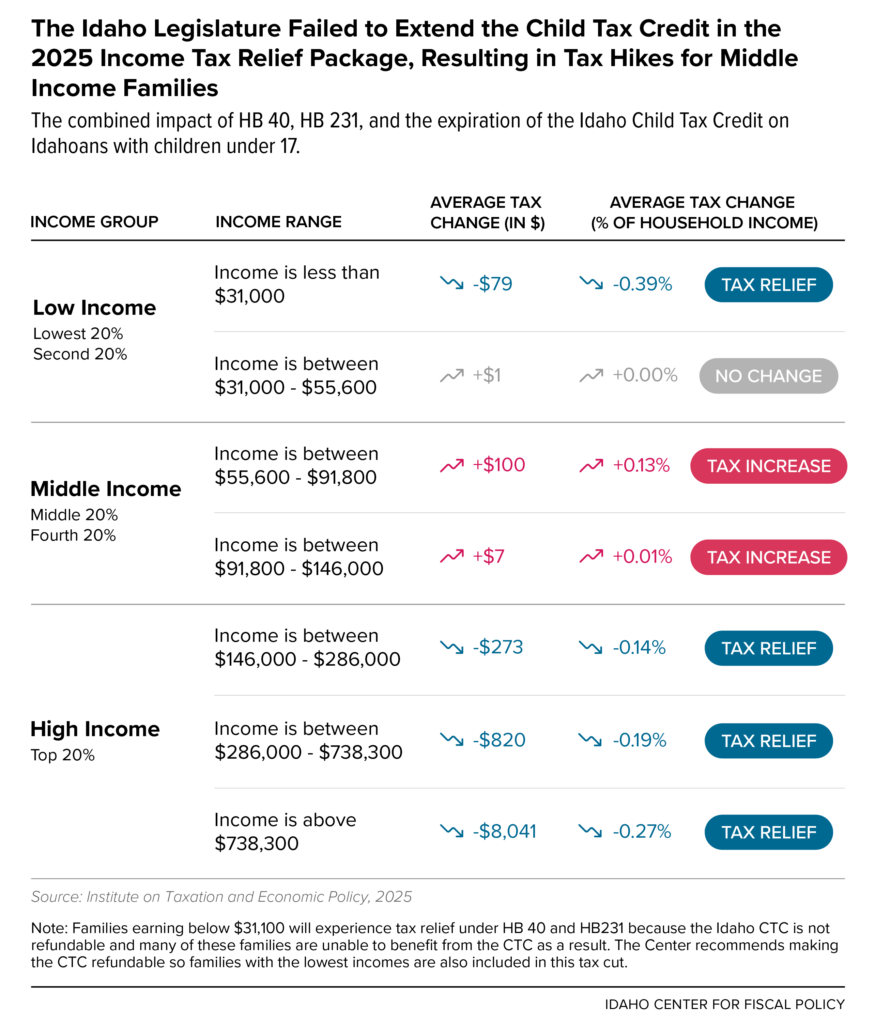

The decision to allow the Child Tax Credit to sunset, when taken into consideration with HB 40 and HB 231, will result in no tax relief for most Idaho families with children next year. Specifically, families earning between $31,100 and $146,000 annually will not see any tax benefit, and families earning between $55,600 and $91,800 will actually experience an annual income tax increase of about $100.

“Idaho lawmakers have made significant cuts to the state’s income tax to provide tax relief to Idahoans this year, but with the expiration of our state Child Tax Credit, most families won’t experience any tax relief,” states May Roberts, Policy Analyst at the Idaho Center for Fiscal Policy. “Lawmakers can take action to ensure low to middle class families aren’t left behind by renewing the Child Tax Credit, incorporating an income cap, and making the credit refundable. These changes will ensure families at low to middle incomes are included in income tax relief and do not experience an increased tax burden in 2026 and beyond.”

For more analysis on House Bill 40, House Bill 231, and the Child Tax Credit, visit our website at https://idahofiscal.org/reports .