Please find a PDF of this analysis here.

The Idaho Legislature is considering a proposal to exempt groceries from the sales tax and eliminate the grocery tax credit. The proposal’s fiscal impacts would all take effect in fiscal year 2019. The proposal sets forth a definition of food products: the same types and kinds of food products that are eligible for purchases with benefits provided under the federal Supplemental Nutrition Assistance Program (SNAP). The definition excludes restaurant sales of food.

Cost

Idaho would forego $79.3 million in revenue annually from this proposal, according the most current estimate from the Legislative Services Office (LSO). This estimate includes a $26.2 million reduction in General Fund dollars to retain and increase the rate of revenue-sharing with local governments. This cost would necessitate either increases in other taxes such as income and property taxes or a reduction in services such as public and charter schools or public health and safety.

Average Tax Change by Income Bracket

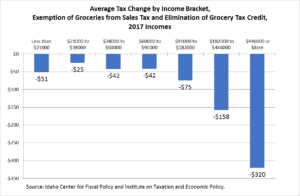

Since higher income households tend to purchase pricier groceries and more of them, the monetary benefits of this proposal are concentrated at the top of the income spectrum (see chart). For every $1 that would go to households that earn under $60,000 per year, about $5 would go to those that earn $60,000 and above (median household income in Idaho in 2015 was $47,583). Tourists and other non-residents would also benefit from this proposal since they pay sales tax on grocery purchases but cannot claim the grocery tax credit. Idahoans in the top 1% of earners – who are likely to buy costlier food in more expensive stores – would see tax reductions of $320 per household, on average (see figure). Middle-income Idaho households would see an average reduction of $42.

Understanding the School Facilities and Tax Relief Bill of 2024

- Idahoans care about the quality of their children’s education, and the quality of the school facility where their children receive their education. However, Idaho